AECOM ACM underwent analysis by 5 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 0 | 0 | 0 |

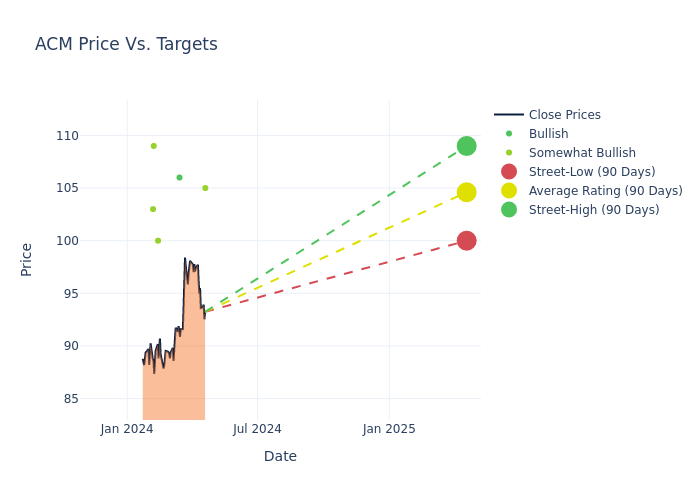

Analysts have recently evaluated AECOM and provided 12-month price targets. The average target is $104.6, accompanied by a high estimate of $109.00 and a low estimate of $100.00. This current average reflects an increase of 6.73% from the previous average price target of $98.00.

Interpreting Analyst Ratings: A Closer Look

The standing of AECOM among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sangita Jain | Keybanc | Raises | Overweight | $105.00 | $104.00 |

| Jamie Cook | Truist Securities | Announces | Buy | $106.00 | - |

| Adam Seiden | Barclays | Raises | Overweight | $100.00 | $90.00 |

| Arthur Nagorny | RBC Capital | Maintains | Outperform | $109.00 | - |

| Andrew Wittmann | Baird | Raises | Outperform | $103.00 | $100.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to AECOM. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of AECOM compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of AECOM's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into AECOM's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on AECOM analyst ratings.

Get to Know AECOM Better

Aecom is one of the largest global providers of design, engineering, construction, and management services. It serves a broad spectrum of end markets including infrastructure, water, transportation, and energy. Based in Los Angeles, Aecom has a presence in over 150 countries and employs 51,000. The company generated $14.4 billion in sales and $847 million in adjusted operating income in fiscal 2023.

A Deep Dive into AECOM's Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Positive Revenue Trend: Examining AECOM's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 15.3% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: AECOM's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 2.42%, the company may face hurdles in effective cost management.

Return on Equity (ROE): AECOM's ROE excels beyond industry benchmarks, reaching 4.24%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): AECOM's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.83%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 1.21, AECOM faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.