Throughout the last three months, 6 analysts have evaluated SAP SAP, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

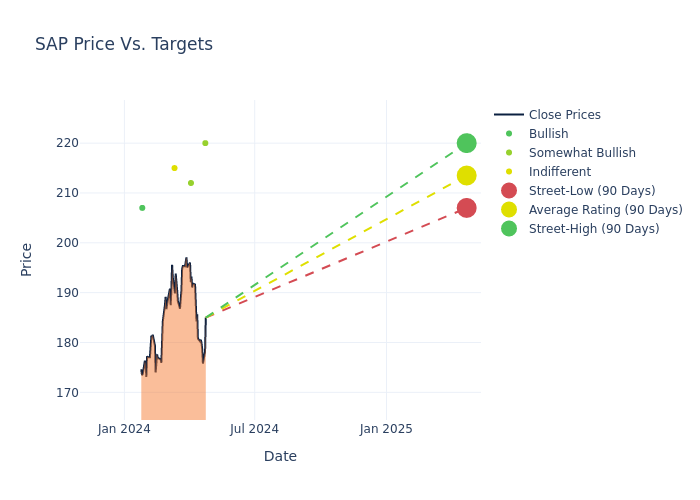

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $206.33, a high estimate of $220.00, and a low estimate of $189.00. Observing a 15.06% increase, the current average has risen from the previous average price target of $179.33.

Investigating Analyst Ratings: An Elaborate Study

The standing of SAP among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Patrick Walravens | JMP Securities | Raises | Market Outperform | $220.00 | $204.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $212.00 | $189.00 |

| Keith Bachman | BMO Capital | Raises | Market Perform | $215.00 | $195.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $189.00 | $156.00 |

| Mohammed Moawalla | Goldman Sachs | Raises | Buy | $207.00 | $185.00 |

| Keith Bachman | BMO Capital | Raises | Market Perform | $195.00 | $147.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to SAP. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of SAP compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of SAP's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into SAP's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on SAP analyst ratings.

All You Need to Know About SAP

Founded in 1972 by former IBM employees, SAP provides database technology and enterprise resource planning software to enterprises around the world. Across more than 180 countries, the company serves 440,000 customers, approximately 80% of which are small- to medium-size enterprises.

SAP: A Financial Overview

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: SAP's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 5.02%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: SAP's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 15.51%, the company may face hurdles in effective cost management.

Return on Equity (ROE): SAP's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 3.05%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): SAP's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.93%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: SAP's debt-to-equity ratio is below the industry average at 0.2, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.