In the latest quarter, 6 analysts provided ratings for Generac Hldgs GNRC, showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 3 | 0 | 0 |

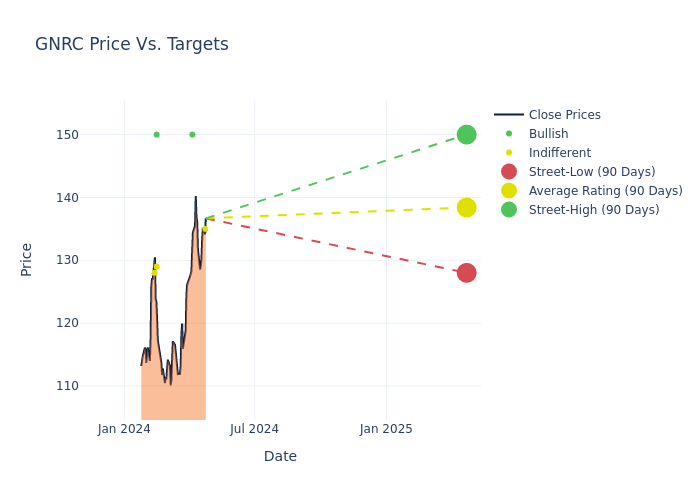

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $135.0, with a high estimate of $150.00 and a low estimate of $118.00. This upward trend is apparent, with the current average reflecting a 6.44% increase from the previous average price target of $126.83.

Interpreting Analyst Ratings: A Closer Look

The perception of Generac Hldgs by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Chip Moore | Roth MKM | Raises | Neutral | $135.00 | $120.00 |

| George Gianarikas | Canaccord Genuity | Raises | Buy | $150.00 | $140.00 |

| Jon Windham | UBS | Lowers | Buy | $150.00 | $160.00 |

| Michael Halloran | Baird | Raises | Neutral | $129.00 | $112.00 |

| J.B. Lowe | Citigroup | Raises | Neutral | $128.00 | $124.00 |

| Chip Moore | Roth MKM | Raises | Neutral | $118.00 | $105.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Generac Hldgs. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Generac Hldgs compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Generac Hldgs's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Generac Hldgs's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Generac Hldgs analyst ratings.

About Generac Hldgs

Generac designs and manufactures power generation equipment serving residential, commercial, and industrial markets. It offers standby generators, portable generators, lighting, outdoor power equipment, and a suite of clean energy products. Sales generated in the United States account for the majority of total sales.

Breaking Down Generac Hldgs's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Generac Hldgs's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 1.38%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Generac Hldgs's net margin excels beyond industry benchmarks, reaching 9.02%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Generac Hldgs's ROE stands out, surpassing industry averages. With an impressive ROE of 4.08%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Generac Hldgs's ROA excels beyond industry benchmarks, reaching 1.87%. This signifies efficient management of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 0.74, Generac Hldgs faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.