In the preceding three months, 10 analysts have released ratings for Maplebear CART, presenting a wide array of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 7 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 3 | 1 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

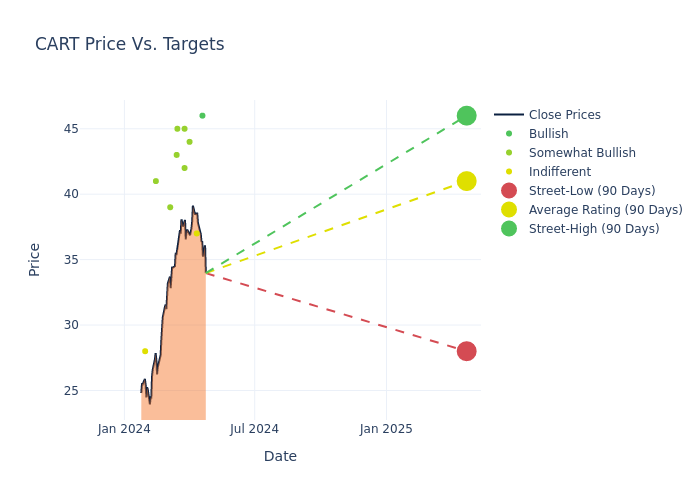

Insights from analysts' 12-month price targets are revealed, presenting an average target of $41.0, a high estimate of $46.00, and a low estimate of $28.00. This upward trend is apparent, with the current average reflecting a 18.12% increase from the previous average price target of $34.71.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Maplebear. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rob Sanderson | Loop Capital | Announces | Buy | $46.00 | - |

| Michael Morton | MoffettNathanson | Raises | Neutral | $37.00 | $36.00 |

| Colin Sebastian | Baird | Raises | Outperform | $44.00 | $31.00 |

| Ross Compton | Macquarie | Announces | Outperform | $42.00 | - |

| Doug Anmuth | JP Morgan | Raises | Overweight | $45.00 | $35.00 |

| Thomas Champion | Piper Sandler | Raises | Overweight | $45.00 | $36.00 |

| Nikhil Devnani | Bernstein | Raises | Outperform | $43.00 | $30.00 |

| Deepak Mathivanan | Wolfe Research | Raises | Outperform | $39.00 | $35.00 |

| Ross Sandler | Barclays | Raises | Overweight | $41.00 | $40.00 |

| Brian Nowak | Morgan Stanley | Announces | Equal-Weight | $28.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Maplebear. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Maplebear compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Maplebear's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Maplebear's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Maplebear analyst ratings.

Discovering Maplebear: A Closer Look

Maplebear, which does business as Instacart, is an online grocery pickup and delivery service provider currently in the United States and Canada. Instacart partners with local and national grocers who provide their selection of food and other goods to customers through Instacart's mobile app or website. After a customer places an order, an independent personal shopper employed by Instacart will pick the order and either prepare it for pickup or deliver it to the customer's chosen location. Instacart's revenue model consists of transaction revenue in the form of retailer and customer fees, as well as advertising revenue from brand advertising on Instacart platforms.

Maplebear's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3 months period, Maplebear showcased positive performance, achieving a revenue growth rate of 6.08% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: Maplebear's net margin is impressive, surpassing industry averages. With a net margin of 16.56%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.68%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Maplebear's ROA stands out, surpassing industry averages. With an impressive ROA of 2.91%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Maplebear's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.