Vertiv Hldgs VRT has been analyzed by 11 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 8 | 1 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 1 | 3 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 1 | 0 | 0 |

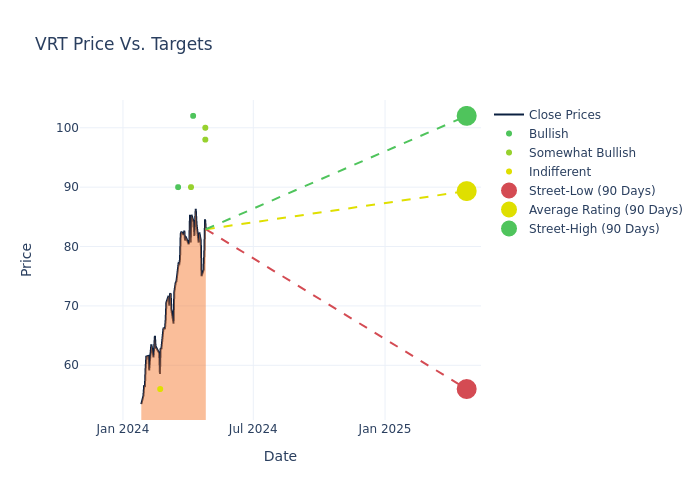

Insights from analysts' 12-month price targets are revealed, presenting an average target of $86.09, a high estimate of $102.00, and a low estimate of $56.00. This upward trend is evident, with the current average reflecting a 19.9% increase from the previous average price target of $71.80.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive Vertiv Hldgs is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Tusa | JP Morgan | Raises | Overweight | $100.00 | $95.00 |

| Noah Kaye | Oppenheimer | Raises | Outperform | $98.00 | $96.00 |

| Stephen Tusa | JP Morgan | Raises | Overweight | $95.00 | $65.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $102.00 | $69.00 |

| Amit Daryanani | Evercore ISI Group | Raises | Outperform | $90.00 | $80.00 |

| Noah Kaye | Oppenheimer | Announces | Outperform | $96.00 | - |

| Andrew Obin | B of A Securities | Raises | Buy | $90.00 | $80.00 |

| Amit Daryanani | Evercore ISI Group | Raises | Outperform | $80.00 | $75.00 |

| Stephen Trent | JP Morgan | Raises | Overweight | $65.00 | $53.00 |

| Brett Linzey | Mizuho | Raises | Neutral | $56.00 | $50.00 |

| Amit Daryanani | Evercore ISI Group | Raises | Outperform | $75.00 | $55.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Vertiv Hldgs. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Vertiv Hldgs compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Vertiv Hldgs's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Vertiv Hldgs's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Vertiv Hldgs analyst ratings.

Get to Know Vertiv Hldgs Better

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Financial Milestones: Vertiv Hldgs's Journey

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3 months period, Vertiv Hldgs showcased positive performance, achieving a revenue growth rate of 12.74% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 12.47%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Vertiv Hldgs's ROE stands out, surpassing industry averages. With an impressive ROE of 12.48%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Vertiv Hldgs's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.02%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.55, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.