10 analysts have expressed a variety of opinions on Lennox Intl LII over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 3 | 1 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 2 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 1 | 0 |

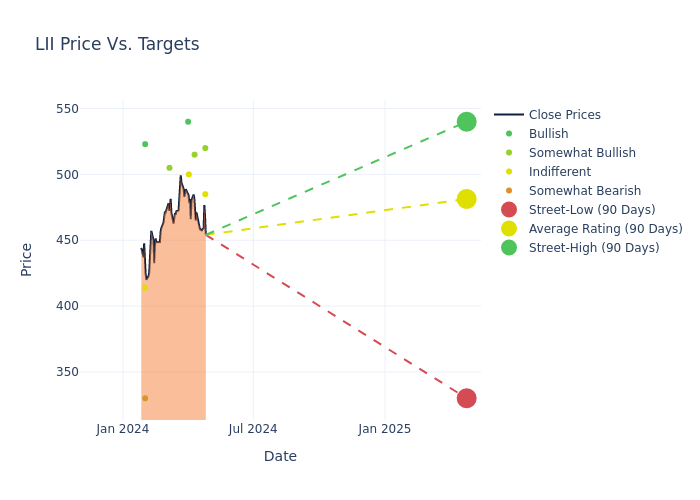

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $487.7, a high estimate of $545.00, and a low estimate of $330.00. This upward trend is evident, with the current average reflecting a 6.07% increase from the previous average price target of $459.78.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Lennox Intl's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Damian Karas | UBS | Raises | Neutral | $485.00 | $450.00 |

| Joseph O'Dea | Wells Fargo | Lowers | Overweight | $520.00 | $545.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $515.00 | $500.00 |

| Julian Mitchell | Barclays | Raises | Equal-Weight | $500.00 | $450.00 |

| Joe O'Dea | Wells Fargo | Raises | Overweight | $545.00 | $491.00 |

| Brett Linzey | Mizuho | Raises | Buy | $540.00 | $490.00 |

| Gautam Khanna | TD Cowen | Raises | Outperform | $505.00 | $450.00 |

| Deane Dray | RBC Capital | Raises | Sector Perform | $414.00 | $392.00 |

| Stephen Tusa | JP Morgan | Lowers | Underweight | $330.00 | $370.00 |

| Nicole Deblase | Deutsche Bank | Announces | Buy | $523.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Lennox Intl. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Lennox Intl compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Lennox Intl's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Lennox Intl analyst ratings.

Delving into Lennox Intl's Background

Lennox International manufactures and distributes heating, ventilating, air conditioning, and refrigeration products to replacement (75% of sales) and new construction (25% of sales) markets. In fiscal 2023, residential HVAC was 68% of sales and commercial HVAC and Heatcraft refrigeration was 32% of sales. The company goes to market with multiple brands, but Lennox is the company's flagship HVAC brand. The Texas-based company will be focused on North America after the sale of its European HVAC and refrigeration businesses in late 2023.

Financial Insights: Lennox Intl

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Lennox Intl's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 5.58%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Lennox Intl's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.51%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Lennox Intl's ROE excels beyond industry benchmarks, reaching 64.97%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Lennox Intl's ROA excels beyond industry benchmarks, reaching 5.08%. This signifies efficient management of assets and strong financial health.

Debt Management: Lennox Intl's debt-to-equity ratio surpasses industry norms, standing at 5.35. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.