Blueprint Medicines BPMC has been analyzed by 7 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 1 | 0 | 1 |

| Last 30D | 2 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 1 |

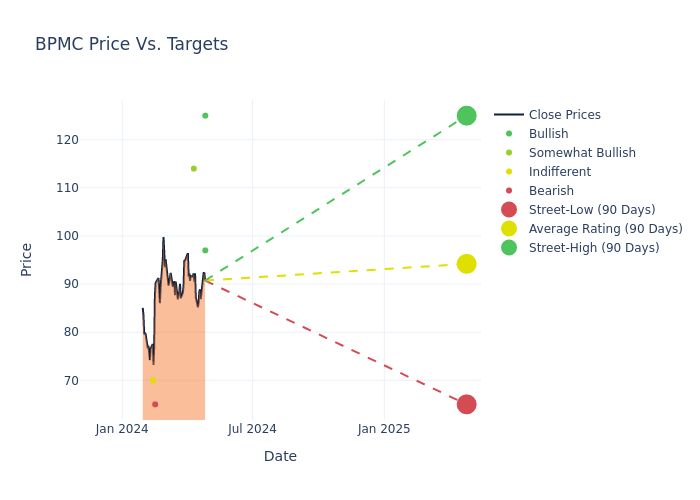

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $97.43, along with a high estimate of $125.00 and a low estimate of $65.00. This upward trend is apparent, with the current average reflecting a 73.98% increase from the previous average price target of $56.00.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive Blueprint Medicines. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Fein | HC Wainwright & Co. | Maintains | Buy | $125.00 | - |

| Ami Fadia | Needham | Maintains | Buy | $97.00 | - |

| Reni Benjamin | JMP Securities | Maintains | Market Outperform | $114.00 | - |

| Ami Fadia | Needham | Maintains | Buy | $97.00 | - |

| Reni Benjamin | JMP Securities | Maintains | Market Outperform | $114.00 | - |

| David Lebowitz | Citigroup | Raises | Sell | $65.00 | $54.00 |

| Peter Lawson | Barclays | Raises | Equal-Weight | $70.00 | $58.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Blueprint Medicines. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Blueprint Medicines compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Blueprint Medicines's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Blueprint Medicines's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Blueprint Medicines analyst ratings.

Discovering Blueprint Medicines: A Closer Look

Blueprint Medicines Corp is a biopharmaceutical company. It is focused on improving the lives of patients with diseases driven by abnormal kinase activation. The company has developed a small molecule drug pipeline in cancer and a rare genetic disease. Its drug candidates includes AYVAKIT for the treatment of systemic mastocytosis, BLU-808 a potential treatment for mast cell disorders, including chronic urticaria, sleep disruption and other related diseases. It also has other drugs in its pipeline such as BLU-956, BLU-222 for treatment of breast cancer.

Understanding the Numbers: Blueprint Medicines's Finances

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Blueprint Medicines's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 85.55%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Blueprint Medicines's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -154.14%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Blueprint Medicines's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -66.57%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Blueprint Medicines's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -10.3%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Blueprint Medicines's debt-to-equity ratio surpasses industry norms, standing at 2.55. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.