Analysts' ratings for Iteris ITI over the last quarter vary from bullish to bearish, as provided by 5 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

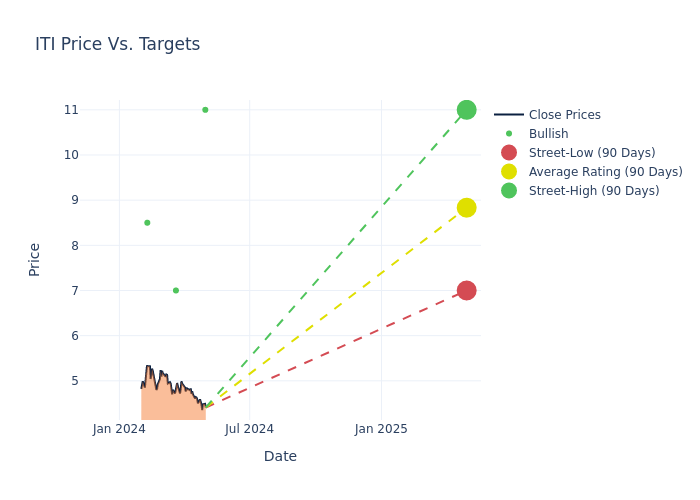

Analysts have set 12-month price targets for Iteris, revealing an average target of $8.1, a high estimate of $11.00, and a low estimate of $7.00. This upward trend is apparent, with the current average reflecting a 27.96% increase from the previous average price target of $6.33.

Exploring Analyst Ratings: An In-Depth Overview

The analysis of recent analyst actions sheds light on the perception of Iteris by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Allen Klee | Maxim Group | Announces | Buy | $11.00 | - |

| Tim Moore | EF Hutton | Maintains | Buy | $7.00 | - |

| Tim Moore | EF Hutton | Maintains | Buy | $7.00 | $7.00 |

| Tim Moore | EF Hutton | Raises | Buy | $7.00 | $6.00 |

| Jeff Van Sinderen | B. Riley Securities | Raises | Buy | $8.50 | $6.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Iteris. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Iteris compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Iteris's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Iteris's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Iteris analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Iteris

Iteris Inc is a provider of smart mobility infrastructure management solutions. Its solutions include traveler information systems, transportation performance measurement software, traffic analytics software, transportation operations software, transportation-related data sets, advanced sensing devices, managed services, traffic engineering services, and mobility consulting services. The company's cloud-enabled end-to-end solutions help public transportation agencies, municipalities, commercial entities and other transportation infrastructure providers monitor, visualize, and optimize mobility infrastructure to make mobility safe, efficient,and sustainable for everyone. The software solutions include ClearGuide, ClearRoute, Commercial Vehicle Operations, BlueArgus, TrafficCarma,and others.

Financial Milestones: Iteris's Journey

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Iteris's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 3.55%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Iteris's net margin is impressive, surpassing industry averages. With a net margin of 0.84%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Iteris's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 0.52%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Iteris's ROA stands out, surpassing industry averages. With an impressive ROA of 0.3%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Iteris's debt-to-equity ratio is below the industry average at 0.09, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.