Analysts' ratings for Navitas Semiconductor NVTS over the last quarter vary from bullish to bearish, as provided by 4 analysts.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

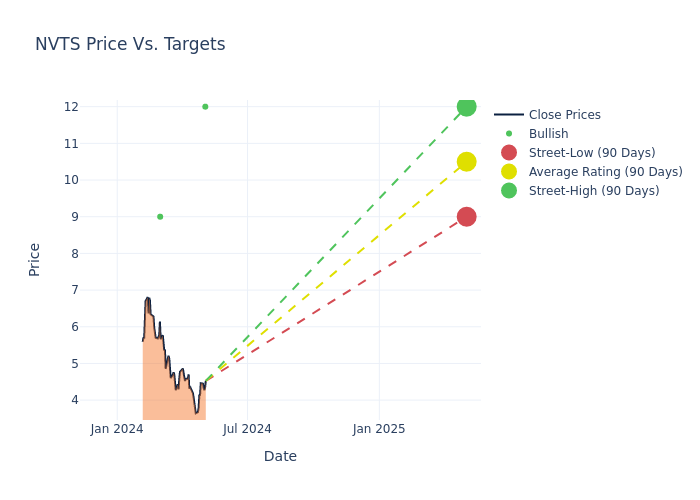

Analysts have set 12-month price targets for Navitas Semiconductor, revealing an average target of $11.25, a high estimate of $12.00, and a low estimate of $9.00. Observing a 2.27% increase, the current average has risen from the previous average price target of $11.00.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Navitas Semiconductor among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kevin Cassidy | Rosenblatt | Maintains | Buy | $12.00 | $12.00 |

| Kevin Cassidy | Rosenblatt | Maintains | Buy | $12.00 | - |

| Kevin Cassidy | Rosenblatt | Maintains | Buy | $12.00 | - |

| Quinn Bolton | Needham | Lowers | Buy | $9.00 | $10.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Navitas Semiconductor. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Navitas Semiconductor compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Navitas Semiconductor's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Navitas Semiconductor's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Navitas Semiconductor analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Navitas Semiconductor: A Closer Look

Navitas Semiconductor Corp develops ultra-efficient gallium nitride (GaN) semiconductors that are revolutionizing power electronics. GaN power ICs integrate GaN power with drive, control, and protection to enable fast charging, high power density, and energy savings for mobile, consumer, enterprise, eMobility, and new energy markets. The company operates as one reportable segment, the design, development, manufacture, and marketing of integrated circuits and related components for use in mobile device and other markets. Geographically, the company operates in China, Europe, United States, Rest of Asia and Others. The majority of revenue is generated from China.

Navitas Semiconductor's Economic Impact: An Analysis

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, Navitas Semiconductor showcased positive performance, achieving a revenue growth rate of 111.0% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -125.03%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Navitas Semiconductor's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -8.31%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Navitas Semiconductor's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -6.65%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Navitas Semiconductor's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.02.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.