During the last three months, 8 analysts shared their evaluations of Ares Management ARES, revealing diverse outlooks from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 6 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 4 | 1 | 0 | 0 |

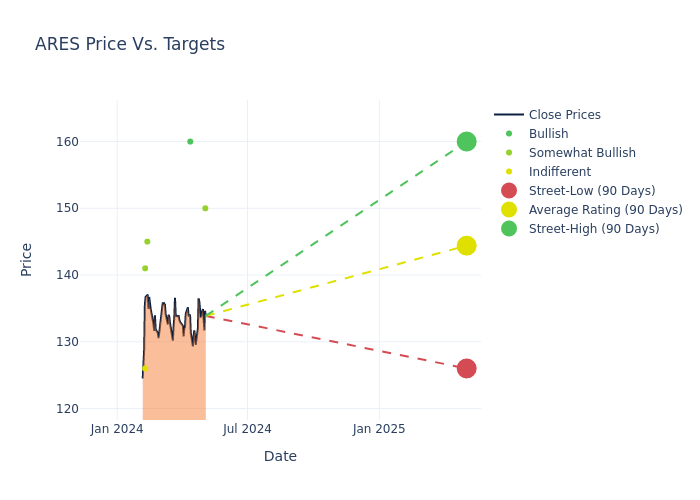

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $145.88, along with a high estimate of $160.00 and a low estimate of $126.00. Marking an increase of 6.29%, the current average surpasses the previous average price target of $137.25.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Ares Management's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Benjamin Budish | Barclays | Lowers | Overweight | $150.00 | $153.00 |

| Joseph Parkhill | UBS | Raises | Buy | $160.00 | $156.00 |

| Benjamin Budish | Barclays | Lowers | Overweight | $153.00 | $157.00 |

| Benjamin Budish | Barclays | Raises | Overweight | $157.00 | $146.00 |

| Kenneth Lee | RBC Capital | Raises | Outperform | $145.00 | $135.00 |

| Kenneth Worthington | JP Morgan | Raises | Overweight | $141.00 | $119.00 |

| Timothy O'Shea | Wells Fargo | Raises | Equal-Weight | $126.00 | $112.00 |

| Kenneth Lee | RBC Capital | Raises | Outperform | $135.00 | $120.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Ares Management. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ares Management compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Ares Management's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Ares Management's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Ares Management analyst ratings.

About Ares Management

Ares Management Corp is an asset management company. It offers investors investment-related advice and strategies for capital growth. The company's operating segments include Credit Group, Private Equity Group, Real Assets and Secondaries Group. Its Credit Group generates maximum revenue, and manages credit strategies across the liquid and illiquid spectrum. Private Equity Group manages investment strategies categorized as corporate private equity, infrastructure and power, and special opportunities, Real Estate Group manages comprehensive equity and debt strategies across real estate and infrastructure investments. The Secondaries Group invests in secondary markets across a range of alternative asset class strategies, including private equity, real estate, infrastructure and credit.

Breaking Down Ares Management's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Ares Management displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 25.09%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 12.74%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Ares Management's ROE excels beyond industry benchmarks, reaching 10.47%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Ares Management's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.79%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 8.32, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.