Advanced Energy Indus AEIS underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

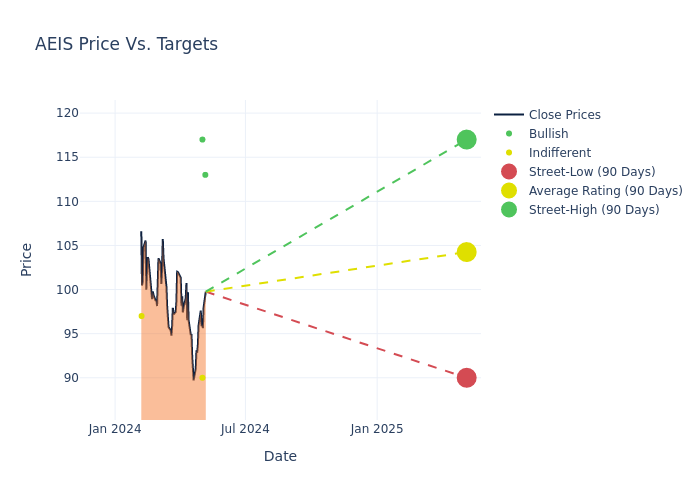

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $104.25, a high estimate of $117.00, and a low estimate of $90.00. This upward trend is apparent, with the current average reflecting a 0.89% increase from the previous average price target of $103.33.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of Advanced Energy Indus by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Atif Malik | Citigroup | Raises | Buy | $113.00 | $107.00 |

| Mark Miller | Benchmark | Maintains | Buy | $117.00 | - |

| Mehdi Hosseini | Susquehanna | Lowers | Neutral | $90.00 | $95.00 |

| Joe Quatrochi | Wells Fargo | Lowers | Equal-Weight | $97.00 | $108.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Advanced Energy Indus. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Advanced Energy Indus compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Advanced Energy Indus's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Advanced Energy Indus's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Advanced Energy Indus analyst ratings.

Get to Know Advanced Energy Indus Better

Advanced Energy Industries Inc provides precision power-conversion measurement and control solutions that transform power into various forms for use in manufacturing and industrial equipment and applications. The firm serves original equipment manufacturers and end customers in the semiconductor, flat panel display, solar panel, and other industrial capital equipment markets. Products include thin-film power-conversion systems, which control and modify raw electrical power into a customizable, predictable power source, and power control modules, which control and measure temperature during manufacturing cycles. A majority of the firm's revenue is generated in the United States, with the rest primarily from Asia and Europe.

Advanced Energy Indus: A Financial Overview

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Advanced Energy Indus's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -17.42% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Advanced Energy Indus's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.25% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Advanced Energy Indus's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.34%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.49%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 0.89, Advanced Energy Indus faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.