In the preceding three months, 8 analysts have released ratings for Westlake WLK, presenting a wide array of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

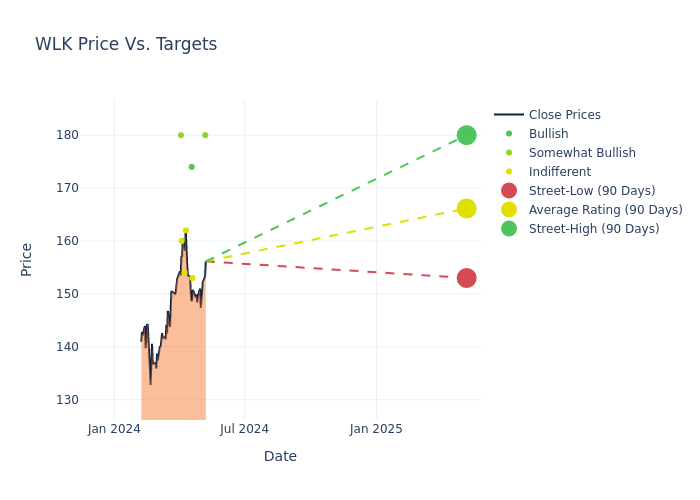

The 12-month price targets, analyzed by analysts, offer insights with an average target of $162.12, a high estimate of $180.00, and a low estimate of $134.00. This current average reflects an increase of 13.14% from the previous average price target of $143.29.

Investigating Analyst Ratings: An Elaborate Study

The analysis of recent analyst actions sheds light on the perception of Westlake by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Charles Neivert | Piper Sandler | Raises | Overweight | $180.00 | $160.00 |

| Arun Viswanathan | RBC Capital | Raises | Sector Perform | $153.00 | $134.00 |

| David Begleiter | B of A Securities | Raises | Buy | $174.00 | $138.00 |

| Patrick Cunningham | Citigroup | Raises | Neutral | $162.00 | $140.00 |

| Kevin McCarthy | Vertical Research | Announces | Hold | $154.00 | - |

| Michael Leithead | Barclays | Raises | Equal-Weight | $160.00 | $142.00 |

| Michael Sison | Wells Fargo | Raises | Overweight | $180.00 | $150.00 |

| Arun Viswanathan | RBC Capital | Lowers | Sector Perform | $134.00 | $139.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Westlake. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Westlake compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Westlake's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Westlake's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Westlake analyst ratings.

About Westlake

Westlake Corp is a manufacturer and supplier of chemicals, polymers and building products. Its Performance and Essential Materials segment offers a wide range of essential building blocks for making products utilized in everyday living, including olefins, vinyl chemicals, polyethylene, and epoxies. Its Housing and Infrastructure Products segment produces key finished goods for building products, pipe and fittings, and global compounds businesses.

Understanding the Numbers: Westlake's Finances

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Challenges: Westlake's revenue growth over 3 months faced difficulties. As of 31 March, 2024, the company experienced a decline of approximately -11.35%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 5.82%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.68%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Westlake's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.82%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.53.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.