Throughout the last three months, 9 analysts have evaluated Crown Castle CCI, offering a diverse set of opinions from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 6 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

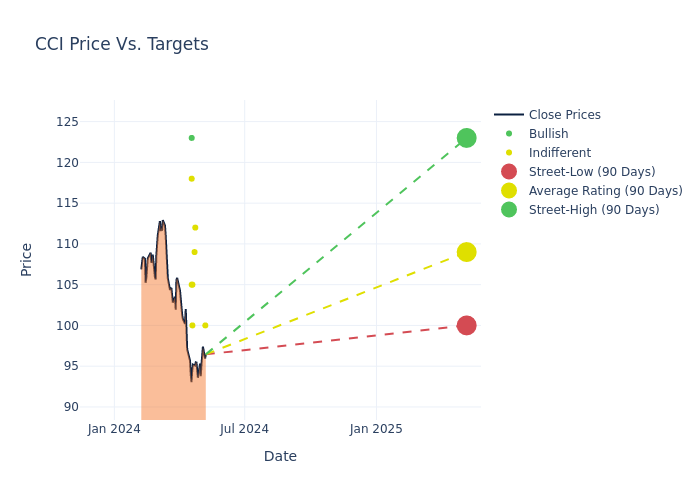

Insights from analysts' 12-month price targets are revealed, presenting an average target of $109.0, a high estimate of $123.00, and a low estimate of $100.00. Observing a downward trend, the current average is 4.39% lower than the prior average price target of $114.00.

Interpreting Analyst Ratings: A Closer Look

The standing of Crown Castle among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jonathan Atkin | RBC Capital | Lowers | Sector Perform | $100.00 | $109.00 |

| Tim Long | Barclays | Raises | Equal-Weight | $112.00 | $111.00 |

| Matthew Niknam | Deutsche Bank | Lowers | Hold | $109.00 | $110.00 |

| Eric Luebchow | Wells Fargo | Lowers | Equal-Weight | $100.00 | $115.00 |

| David Barden | B of A Securities | Lowers | Neutral | $105.00 | $120.00 |

| Jonathan Petersen | Jefferies | Lowers | Buy | $123.00 | $126.00 |

| Ari Klein | BMO Capital | Lowers | Market Perform | $105.00 | $110.00 |

| Maher Yaghi | Scotiabank | Lowers | Sector Perform | $118.00 | $133.00 |

| Jonathan Atkin | RBC Capital | Raises | Sector Perform | $109.00 | $92.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Crown Castle. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Crown Castle compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Crown Castle's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Crown Castle's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Crown Castle analyst ratings.

About Crown Castle

Crown Castle International owns and leases roughly 40,000 cell towers in the United States. It also owns more than 85,000 route miles of fiber. It leases space on its towers to wireless service providers, which install equipment on the towers to support their wireless networks. The company's fiber is primarily leased by wireless service providers to set up small-cell network infrastructure and by enterprises for their internal connection needs. Crown Castle's towers and fiber are predominantly located in the largest U.S. cities. The company has a very concentrated customer base, with about 75% of its revenue coming from the big three U.S. mobile carriers. Crown Castle operates as a real estate investment trust.

Breaking Down Crown Castle's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Crown Castle's revenue growth over a period of 3 months has faced challenges. As of 31 March, 2024, the company experienced a revenue decline of approximately -7.45%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: Crown Castle's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 18.95%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 5.0%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Crown Castle's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.81%, the company showcases efficient use of assets and strong financial health.

Debt Management: Crown Castle's debt-to-equity ratio is below the industry average at 4.82, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.