Across the recent three months, 13 analysts have shared their insights on Best Buy Co BBY, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 8 | 0 | 2 |

| Last 30D | 0 | 0 | 0 | 0 | 1 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 8 | 0 | 1 |

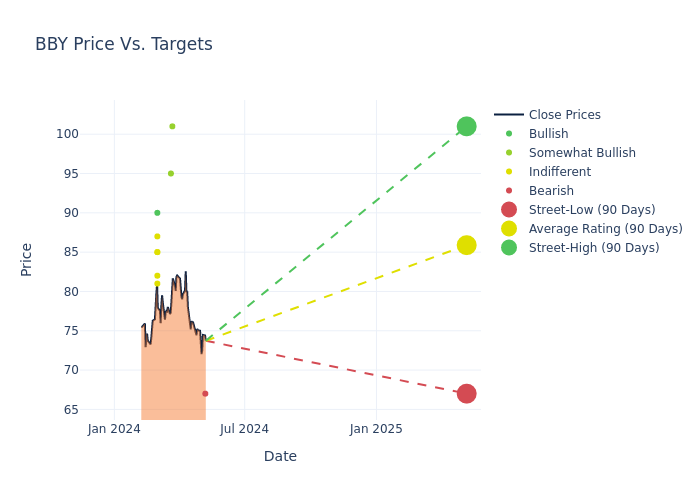

Analysts have set 12-month price targets for Best Buy Co, revealing an average target of $84.46, a high estimate of $101.00, and a low estimate of $67.00. Witnessing a positive shift, the current average has risen by 9.57% from the previous average price target of $77.08.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Best Buy Co's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Steven Zaccone | Citigroup | Lowers | Sell | $67.00 | $76.00 |

| Christopher Horvers | JP Morgan | Raises | Overweight | $101.00 | $89.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $95.00 | $85.00 |

| Simeon Gutman | Morgan Stanley | Raises | Equal-Weight | $82.00 | $80.00 |

| Steven Zaccone | Citigroup | Raises | Sell | $76.00 | $67.00 |

| Michael Lasser | UBS | Raises | Neutral | $85.00 | $82.00 |

| Christopher Horvers | JP Morgan | Raises | Neutral | $89.00 | $78.00 |

| Seth Sigman | Barclays | Raises | Equal-Weight | $81.00 | $69.00 |

| Kate McShane | Goldman Sachs | Raises | Buy | $90.00 | $81.00 |

| Seth Basham | Wedbush | Raises | Neutral | $85.00 | $75.00 |

| Scot Ciccarelli | Truist Securities | Raises | Hold | $87.00 | $68.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Market Perform | $85.00 | $75.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Market Perform | $75.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Best Buy Co. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Best Buy Co compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Best Buy Co's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Best Buy Co's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Best Buy Co analyst ratings.

Delving into Best Buy Co's Background

With $43.5 billion in consolidated 2023 sales, Best Buy is the largest pure-play consumer electronics retailer in the U.S., boasting roughly 8.3% share of the North American market and north of 33% share of offline sales in the region, per our calculations, CTA, and Euromonitor data. The firm generates the bulk of its sales in-store, with mobile phones and tablets, computers, and appliances representing its three largest categories. Recent investments in e-commerce fulfillment, accelerated by the COVID-19 pandemic, have seen the U.S. e-commerce channel roughly double from prepandemic levels, with management estimating that it will represent a mid-30% proportion of sales moving forward.

Best Buy Co: Delving into Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Decline in Revenue: Over the 3 months period, Best Buy Co faced challenges, resulting in a decline of approximately -0.6% in revenue growth as of 31 January, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Best Buy Co's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 3.14%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Best Buy Co's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 15.69%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.89%, the company showcases effective utilization of assets.

Debt Management: Best Buy Co's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.3.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.