Analysts' ratings for Kenvue KVUE over the last quarter vary from bullish to bearish, as provided by 7 analysts.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 3 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 2 | 0 | 0 |

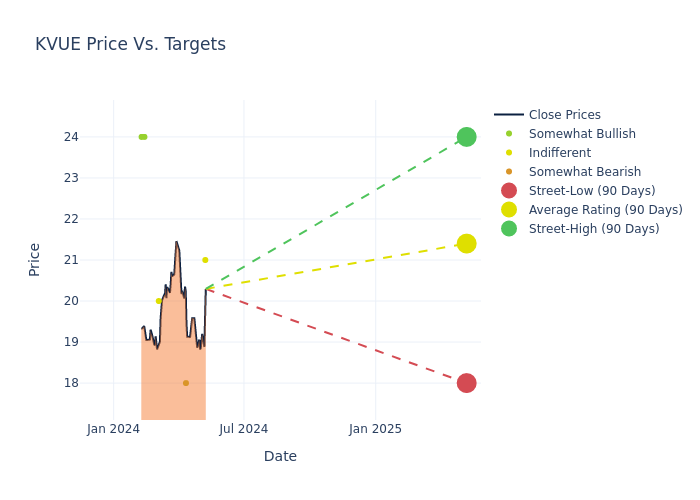

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $21.57, a high estimate of $24.00, and a low estimate of $18.00. A 7.03% drop is evident in the current average compared to the previous average price target of $23.20.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Kenvue by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeremy Fialko | HSBC | Raises | Hold | $21.00 | $20.00 |

| Callum Elliott | Bernstein | Announces | Underperform | $18.00 | - |

| Bonnie Herzog | Goldman Sachs | Lowers | Neutral | $20.00 | $26.00 |

| Bonnie Herzog | Goldman Sachs | Maintains | Neutral | $20.00 | $20.00 |

| Nik Modi | RBC Capital | Maintains | Outperform | $24.00 | - |

| Andrea Teixeira | JP Morgan | Lowers | Overweight | $24.00 | $25.00 |

| Nik Modi | RBC Capital | Lowers | Outperform | $24.00 | $25.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kenvue. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Kenvue compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Kenvue's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Kenvue's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Kenvue analyst ratings.

About Kenvue

Kenvue is the world's largest pure-play consumer health company by sales, generating $15 billion in annual revenue. Formerly known as Johnson & Johnson's consumer segment, Kenvue spun off and went public in May 2023. It operates in a variety of silos within consumer health, such as cough, cold and allergy care, pain management, face and body care, and oral care, as well as women's health. Its portfolio includes a wide array of some of the most well-known brands in the space, including Tylenol, Listerine, Johnson's, Aveeno, and Neutrogena. Despite playing in a fragmented industry with intense competition and ever-changing consumer preferences, many of Kenvue's brands are the global leader in their respective segment thanks to their strong brand power.

Unraveling the Financial Story of Kenvue

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Decline in Revenue: Over the 3 months period, Kenvue faced challenges, resulting in a decline of approximately -2.68% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 8.92%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Kenvue's ROE excels beyond industry benchmarks, reaching 2.96%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Kenvue's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.19% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Kenvue's debt-to-equity ratio is below the industry average at 0.75, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.