Throughout the last three months, 24 analysts have evaluated Costco Wholesale COST, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 14 | 6 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 4 | 3 | 0 | 0 |

| 2M Ago | 1 | 3 | 1 | 0 | 0 |

| 3M Ago | 2 | 6 | 2 | 0 | 0 |

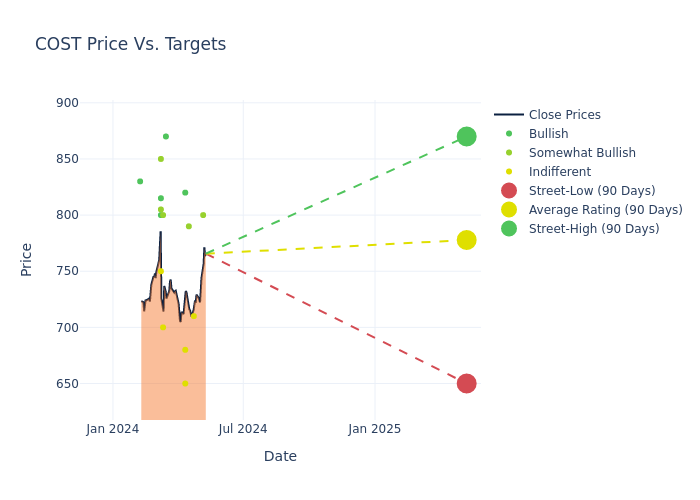

Analysts have set 12-month price targets for Costco Wholesale, revealing an average target of $779.38, a high estimate of $870.00, and a low estimate of $650.00. Witnessing a positive shift, the current average has risen by 5.04% from the previous average price target of $742.00.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Costco Wholesale. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $800.00 | $800.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $800.00 | $800.00 |

| Paul Lejuez | Citigroup | Raises | Neutral | $710.00 | $630.00 |

| Greg Melich | Evercore ISI Group | Lowers | Outperform | $790.00 | $805.00 |

| Laura Champine | Loop Capital | Lowers | Buy | $820.00 | $830.00 |

| Michael Baker | DA Davidson | Maintains | Neutral | $680.00 | $680.00 |

| Greg Melich | Evercore ISI Group | Raises | Outperform | $805.00 | $795.00 |

| Bill Kirk | Roth MKM | Raises | Neutral | $650.00 | $601.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $800.00 | $800.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $800.00 | $800.00 |

| Chuck Grom | Gordon Haskett | Announces | Accumulate | $775.00 | - |

| Ivan Feinseth | Tigress Financial | Raises | Buy | $870.00 | $745.00 |

| Kelly Bania | BMO Capital | Raises | Outperform | $800.00 | $770.00 |

| Seth Sigman | Barclays | Raises | Equal-Weight | $700.00 | $614.00 |

| Michael Baker | DA Davidson | Raises | Neutral | $680.00 | $600.00 |

| Mark Astrachan | Stifel | Raises | Buy | $800.00 | $735.00 |

| Greg Melich | Evercore ISI Group | Raises | Outperform | $815.00 | $770.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $815.00 | $741.00 |

| Rupesh Parikh | Oppenheimer | Maintains | Outperform | $805.00 | $805.00 |

| George Kelly | Wells Fargo | Raises | Equal-Weight | $750.00 | $675.00 |

| Peter Benedict | Baird | Raises | Outperform | $850.00 | $775.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $800.00 | $785.00 |

| Rupesh Parikh | Oppenheimer | Raises | Outperform | $805.00 | $760.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $785.00 | $750.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Costco Wholesale. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Costco Wholesale compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Costco Wholesale's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Costco Wholesale's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Costco Wholesale analyst ratings.

Get to Know Costco Wholesale Better

Costco operates a membership-based, no-frills retail model, predicated on offering a select product assortment in bulk quantities at bargain prices. The firm avoids maintaining costly product displays by keeping inventory on pallets and limits distribution expenses by storing its inventory at point of sale in the warehouse. Given Costco's frugal cost structure, the firm is able to price its merchandise below competing retailers, driving high sales volume per warehouse and allowing the retailer to generate strong profits on thin margins. Costco operates over 600 warehouses in the United States and boasts over 60% market share in the domestic warehouse club industry. Internationally, Costco operates another 270 warehouses, primarily in markets such as Canada, Mexico, Japan, and the UK.

Financial Milestones: Costco Wholesale's Journey

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Costco Wholesale showcased positive performance, achieving a revenue growth rate of 5.75% as of 29 February, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Costco Wholesale's net margin excels beyond industry benchmarks, reaching 2.98%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Costco Wholesale's ROE excels beyond industry benchmarks, reaching 7.43%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Costco Wholesale's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.49%, the company showcases efficient use of assets and strong financial health.

Debt Management: Costco Wholesale's debt-to-equity ratio is below the industry average at 0.45, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.