Across the recent three months, 8 analysts have shared their insights on Choice Hotels Intl CHH, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 3 | 3 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 1 | 0 |

| 2M Ago | 0 | 1 | 2 | 1 | 0 |

| 3M Ago | 0 | 0 | 0 | 1 | 0 |

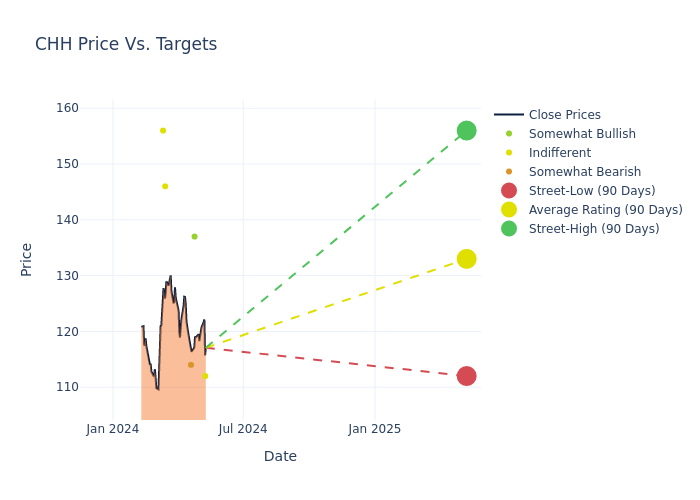

Analysts have set 12-month price targets for Choice Hotels Intl, revealing an average target of $130.75, a high estimate of $156.00, and a low estimate of $112.00. This upward trend is evident, with the current average reflecting a 4.7% increase from the previous average price target of $124.88.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of Choice Hotels Intl by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Carlo Santarelli | Deutsche Bank | Lowers | Hold | $112.00 | $128.00 |

| Michael Bellisario | Baird | Lowers | Outperform | $137.00 | $140.00 |

| Anthony Powell | Barclays | Lowers | Underweight | $114.00 | $122.00 |

| Patrick Scholes | Truist Securities | Raises | Hold | $146.00 | $142.00 |

| Michael Bellisario | Baird | Raises | Outperform | $140.00 | $138.00 |

| Anthony Powell | Barclays | Raises | Underweight | $122.00 | $119.00 |

| David Katz | Jefferies | Raises | Hold | $156.00 | $96.00 |

| Brandt Montour | Barclays | Raises | Underweight | $119.00 | $114.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Choice Hotels Intl. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Choice Hotels Intl compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Choice Hotels Intl's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Choice Hotels Intl's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Choice Hotels Intl analyst ratings.

About Choice Hotels Intl

As of Dec. 31, 2023, Choice Hotels operated 633,000 rooms across 15 brands addressing the economy and midscale segments. Comfort Inn and Comfort Suites are the largest brands (27% of the company's total domestic rooms), while Ascend and Cambria (7% of total domestic rooms) are newer lifestyle and select-service brands. Choice closed on its Radisson acquisition in August 2022, which added around 70,000 rooms. Franchises account for 100% of total revenue, and the United States represent 79% of total rooms in 2023.

Choice Hotels Intl: Financial Performance Dissected

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Choice Hotels Intl's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -0.99% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Choice Hotels Intl's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 8.04%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Choice Hotels Intl's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 53.34% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.25%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 47.24, Choice Hotels Intl faces challenges in effectively managing its debt levels, indicating potential financial strain.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.