9 analysts have shared their evaluations of Oshkosh OSK during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

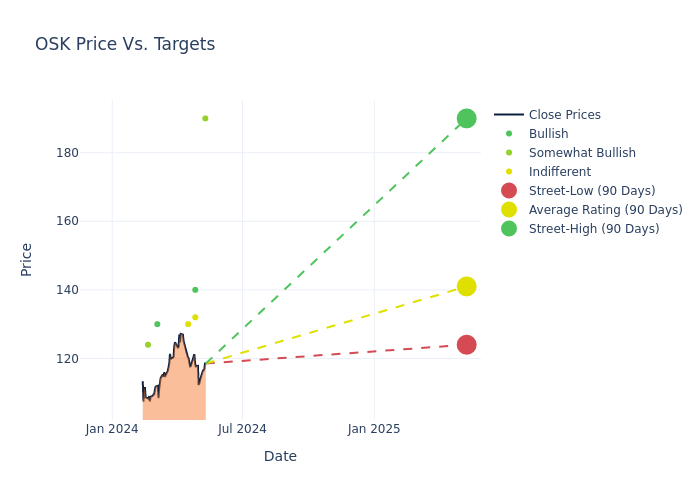

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $139.44, a high estimate of $190.00, and a low estimate of $121.00. Observing a 7.26% increase, the current average has risen from the previous average price target of $130.00.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Oshkosh by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mircea Dobre | Baird | Raises | Outperform | $190.00 | $158.00 |

| Jamie Cook | Truist Securities | Raises | Hold | $132.00 | $121.00 |

| Nathan Jones | Stifel | Raises | Buy | $140.00 | $135.00 |

| Mircea Dobre | Baird | Raises | Outperform | $158.00 | $140.00 |

| Tami Zakaria | JP Morgan | Raises | Neutral | $130.00 | $120.00 |

| Jamie Cook | Truist Securities | Announces | Hold | $121.00 | - |

| Michael Shlisky | DA Davidson | Raises | Buy | $130.00 | $122.00 |

| Michael Shlisky | DA Davidson | Raises | Buy | $130.00 | $122.00 |

| David Raso | Evercore ISI Group | Raises | Outperform | $124.00 | $122.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Oshkosh. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Oshkosh compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Oshkosh's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Oshkosh's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Oshkosh analyst ratings.

About Oshkosh

Oshkosh is the top producer of access equipment, specialty vehicles, and military trucks. It serves diverse end markets, where it is typically the market share leader in North America, or, in the case of JLG aerial work platforms, a global leader. The company had manufactured joint light tactical vehicles for the us Department of Defense. However, Oshkosh recently lost the JLTV recompete, bringing into focus its us Postal Service contract, which calls for the electrification of us postal vehicles. The company reports in three segments—access equipment (52% of revenue), defense (22%), and vocational (27%)—and generated $9.6 billion in revenue in 2023.

Unraveling the Financial Story of Oshkosh

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Oshkosh displayed positive results in 3 months. As of 31 March, 2024, the company achieved a solid revenue growth rate of approximately 12.16%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Oshkosh's net margin excels beyond industry benchmarks, reaching 7.05%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Oshkosh's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 4.76%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.93%, the company showcases effective utilization of assets.

Debt Management: Oshkosh's debt-to-equity ratio is below the industry average at 0.32, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.