20 analysts have shared their evaluations of ON Semiconductor ON during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 9 | 5 | 5 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 8 | 4 | 3 | 1 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

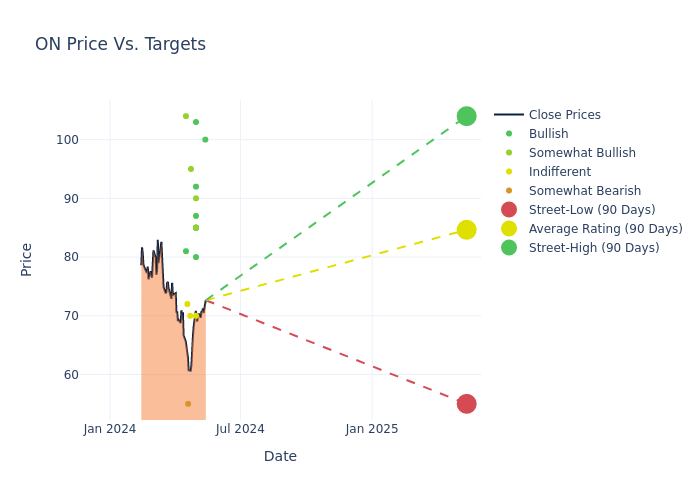

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $84.65, along with a high estimate of $104.00 and a low estimate of $55.00. This current average represents a 7.79% decrease from the previous average price target of $91.80.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of ON Semiconductor among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Blayne Curtis | Jefferies | Raises | Buy | $100.00 | $95.00 |

| William Stein | Truist Securities | Lowers | Buy | $85.00 | $89.00 |

| Ross Seymore | Deutsche Bank | Lowers | Buy | $85.00 | $90.00 |

| Joshua Buchalter | TD Cowen | Lowers | Buy | $85.00 | $90.00 |

| Vijay Rakesh | Mizuho | Lowers | Buy | $87.00 | $92.00 |

| Craig Ellis | B. Riley Securities | Lowers | Buy | $103.00 | $115.00 |

| David Williams | Benchmark | Lowers | Buy | $80.00 | $88.00 |

| John Vinh | Keybanc | Lowers | Overweight | $90.00 | $100.00 |

| Kevin Cassidy | Rosenblatt | Lowers | Neutral | $70.00 | $75.00 |

| Christopher Rolland | Susquehanna | Lowers | Positive | $85.00 | $90.00 |

| Quinn Bolton | Needham | Maintains | Buy | $92.00 | - |

| Gary Mobley | Wells Fargo | Lowers | Overweight | $95.00 | $110.00 |

| Joseph Moore | Morgan Stanley | Lowers | Equal-Weight | $70.00 | $80.00 |

| David O'Connor | Exane BNP Paribas | Announces | Underperform | $55.00 | - |

| Tore Svanberg | Stifel | Lowers | Hold | $72.00 | $82.00 |

| Toshiya Hari | Goldman Sachs | Lowers | Buy | $81.00 | $91.00 |

| Mark Lipacis | Evercore ISI Group | Announces | Outperform | $104.00 | - |

| Christopher Rolland | Susquehanna | Maintains | Positive | $90.00 | $90.00 |

| Tore Svanberg | Stifel | Maintains | Hold | $82.00 | - |

| Tore Svanberg | Stifel | Maintains | Hold | $82.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to ON Semiconductor. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of ON Semiconductor compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for ON Semiconductor's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of ON Semiconductor's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on ON Semiconductor analyst ratings.

Discovering ON Semiconductor: A Closer Look

Onsemi is a supplier of power semiconductors and sensors focused on the automotive and industrial markets. Onsemi is the second-largest power chipmaker in the world and the largest supplier of image sensors to the automotive market. While the firm used to be highly vertically integrated, it now pursues a hybrid manufacturing strategy for flexible capacity. Onsemi is pivoting to focus on emerging applications like electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

Financial Insights: ON Semiconductor

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: ON Semiconductor's revenue growth over 3 months faced difficulties. As of 31 March, 2024, the company experienced a decline of approximately -4.95%. This indicates a decrease in top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: ON Semiconductor's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 24.32% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): ON Semiconductor's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.7%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): ON Semiconductor's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.39%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.41, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.