In the latest quarter, 7 analysts provided ratings for Alaska Air Gr ALK, showcasing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 2 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

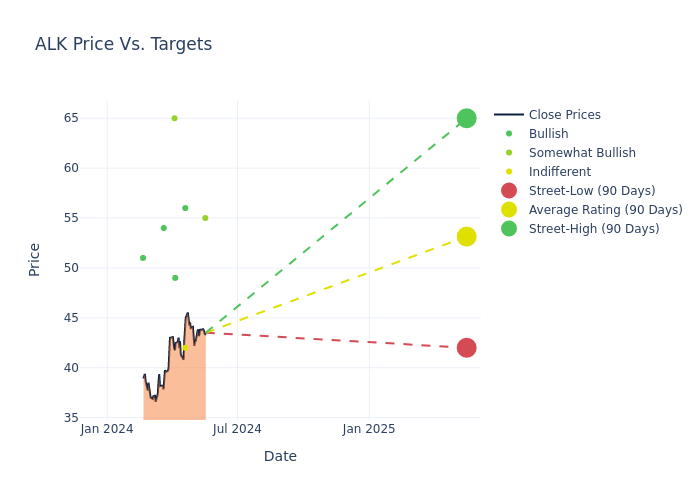

Analysts have recently evaluated Alaska Air Gr and provided 12-month price targets. The average target is $53.14, accompanied by a high estimate of $65.00 and a low estimate of $42.00. Surpassing the previous average price target of $46.00, the current average has increased by 15.52%.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Alaska Air Gr by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Group | Wolfe Research | Announces | Outperform | $55.00 | - |

| Christopher Danely | Susquehanna | Raises | Neutral | $42.00 | $40.00 |

| Andrew Didora | B of A Securities | Raises | Buy | $56.00 | $50.00 |

| Helane Becker | TD Cowen | Raises | Buy | $49.00 | $41.00 |

| Duane Pfennigwerth | Evercore ISI Group | Raises | Outperform | $65.00 | $55.00 |

| Atul Maheswari | UBS | Announces | Buy | $54.00 | - |

| Michael Linenberg | Deutsche Bank | Raises | Buy | $51.00 | $44.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Alaska Air Gr. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Alaska Air Gr compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Alaska Air Gr's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Alaska Air Gr's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Alaska Air Gr analyst ratings.

Delving into Alaska Air Gr's Background

Alaska Air Group Inc operates two airlines, Alaska and Horizon in three operating segments. The Mainline segment includes scheduled air transportation on Alaska's Boeing and Airbus jet aircraft for passengers and cargo throughout the U.S., and in parts of Mexico, and Costa Rica. The Regional segment includes Horizon's and other third-party carriers' scheduled air transportation for passengers across a shorter distance network within the U.S. and Canada under capacity purchase agreements (CPA). The Horizon segment includes the capacity sold to Alaska under a CPA. It earns revenues from Passenger tickets, including ticket breakage and net of taxes and fees, Passenger ancillary and Mileage Plan passenger revenue.

Understanding the Numbers: Alaska Air Gr's Finances

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Alaska Air Gr displayed positive results in 3 months. As of 31 March, 2024, the company achieved a solid revenue growth rate of approximately 1.64%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Alaska Air Gr's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -5.91%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Alaska Air Gr's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -3.26%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Alaska Air Gr's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.9%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.96, Alaska Air Gr adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.