In the last three months, 17 analysts have published ratings on Fiserv FI, offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 9 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 4 | 4 | 1 | 0 | 0 |

| 2M Ago | 1 | 5 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

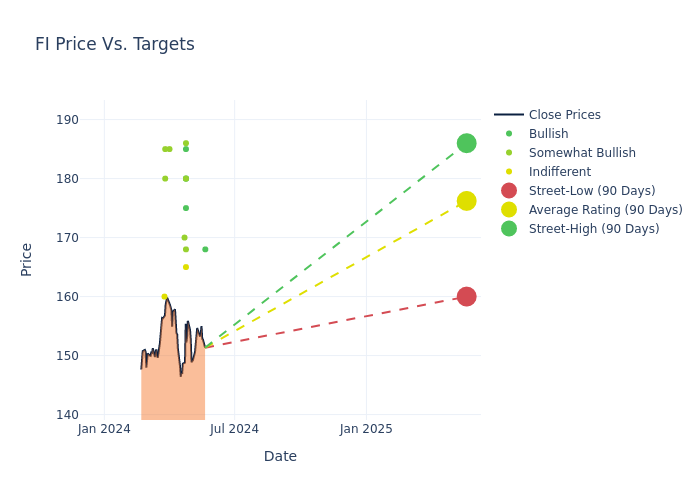

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $175.76, a high estimate of $186.00, and a low estimate of $156.00. Marking an increase of 4.93%, the current average surpasses the previous average price target of $167.50.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Fiserv's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dan Dolev | Mizuho | Raises | Buy | $168.00 | $156.00 |

| Ashwin Shirvaikar | Citigroup | Raises | Buy | $180.00 | $171.00 |

| Bryan Bergin | TD Cowen | Raises | Buy | $175.00 | $167.00 |

| Hal Goetsch | B. Riley Securities | Raises | Buy | $180.00 | $176.00 |

| Daniel Perlin | RBC Capital | Raises | Outperform | $180.00 | $158.00 |

| Charles Nabhan | Stephens & Co. | Maintains | Equal-Weight | $165.00 | - |

| Timothy Chiodo | UBS | Raises | Buy | $185.00 | $170.00 |

| Rufus Hone | BMO Capital | Raises | Outperform | $168.00 | $163.00 |

| David Koning | Baird | Raises | Outperform | $186.00 | $185.00 |

| Alex Markgraff | Keybanc | Raises | Overweight | $170.00 | $160.00 |

| David Koning | Baird | Raises | Outperform | $185.00 | $168.00 |

| David Anderson | Barclays | Raises | Overweight | $185.00 | $165.00 |

| Dan Dolev | Mizuho | Maintains | Buy | $156.00 | $156.00 |

| Omer Saad | Evercore ISI Group | Maintains | Outperform | $185.00 | $185.00 |

| James Friedman | Susquehanna | Raises | Positive | $180.00 | $175.00 |

| Brad Handler | Jefferies | Raises | Hold | $160.00 | $150.00 |

| James Friedman | Susquehanna | Raises | Positive | $180.00 | $175.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Fiserv. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Fiserv compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Fiserv's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Fiserv's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Fiserv analyst ratings.

Delving into Fiserv's Background

Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for us banks and credit unions, with a focus on small and midsize banks. Through the merger with First Data in 2019, Fiserv also provides payment processing services for merchants. About 10% of the company's revenue is generated internationally.

Fiserv's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Fiserv's remarkable performance in 3 months is evident. As of 31 March, 2024, the company achieved an impressive revenue growth rate of 7.39%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Fiserv's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 15.05%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Fiserv's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.51%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Fiserv's ROA stands out, surpassing industry averages. With an impressive ROA of 0.8%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Fiserv's debt-to-equity ratio is below the industry average. With a ratio of 0.85, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.