Analysts' ratings for Baidu BIDU over the last quarter vary from bullish to bearish, as provided by 6 analysts.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

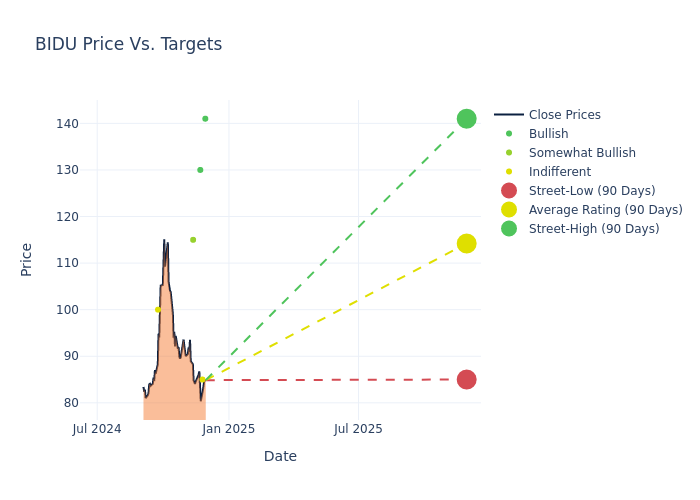

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $112.67, along with a high estimate of $141.00 and a low estimate of $85.00. A 12.93% drop is evident in the current average compared to the previous average price target of $129.40.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Baidu among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alicia Yap | Citigroup | Lowers | Buy | $141.00 | $142.00 |

| Shyam Patil | Susquehanna | Lowers | Neutral | $85.00 | $105.00 |

| Fawne Jiang | Benchmark | Lowers | Buy | $130.00 | $135.00 |

| James Lee | Mizuho | Lowers | Outperform | $115.00 | $130.00 |

| Charlene Liu | HSBC | Announces | Hold | $100.00 | - |

| Shyam Patil | Susquehanna | Lowers | Positive | $105.00 | $135.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Baidu. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Baidu compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Baidu's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Baidu's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Baidu analyst ratings.

Discovering Baidu: A Closer Look

Baidu is the largest internet search engine in China with over 50% share of the search engine market in 2024 per web analytics firm, Statcounter. The firm generated 72% of core revenue from online marketing services from its search engine in 2023. Outside its search engine, Baidu is a technology-driven company and its other major growth initiatives are artificial intelligence cloud, video streaming services, voice recognition technology, and autonomous driving.

Baidu: A Financial Overview

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Baidu's revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -2.58%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: Baidu's net margin excels beyond industry benchmarks, reaching 22.74%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Baidu's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.98% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Baidu's ROA excels beyond industry benchmarks, reaching 1.83%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.3.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.