Ratings for Emerson Electric EMR were provided by 11 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 4 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 3 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 1 | 0 |

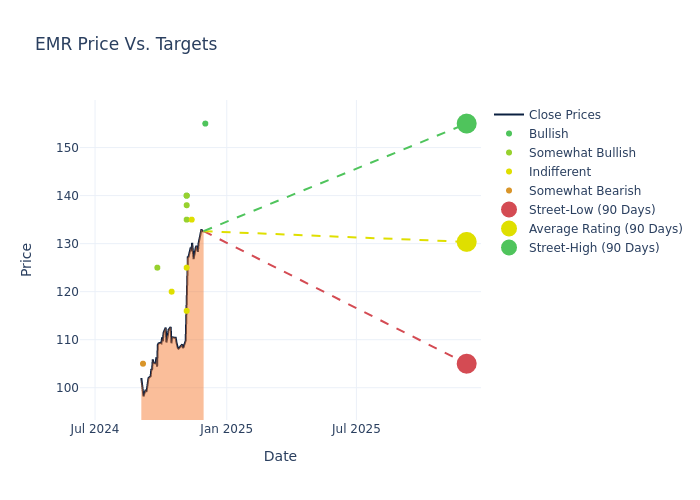

Analysts have set 12-month price targets for Emerson Electric, revealing an average target of $130.36, a high estimate of $155.00, and a low estimate of $105.00. Observing a 3.96% increase, the current average has risen from the previous average price target of $125.40.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Emerson Electric's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Chris Dankert | Loop Capital | Raises | Buy | $155.00 | $130.00 |

| Chris Snyder | UBS | Raises | Neutral | $135.00 | $120.00 |

| Deane Dray | RBC Capital | Lowers | Outperform | $138.00 | $139.00 |

| Joseph O'Dea | Wells Fargo | Raises | Overweight | $135.00 | $128.00 |

| Julian Mitchell | Barclays | Raises | Equal-Weight | $116.00 | $103.00 |

| Ken Newman | Keybanc | Raises | Overweight | $140.00 | $125.00 |

| Michael Halloran | Baird | Raises | Neutral | $125.00 | $118.00 |

| Nicole Deblase | Deutsche Bank | Raises | Buy | $140.00 | $136.00 |

| Tommy Moll | Stephens & Co. | Lowers | Equal-Weight | $120.00 | $135.00 |

| Christopher Glynn | Oppenheimer | Raises | Outperform | $125.00 | $120.00 |

| Chris Snyder | Morgan Stanley | Announces | Underweight | $105.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Emerson Electric. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Emerson Electric compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Emerson Electric's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Emerson Electric's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Emerson Electric analyst ratings.

Discovering Emerson Electric: A Closer Look

Founded in 1890 as the first manufacturer of electric fans in North America, Emerson Electric has become a leading industrial automation player through the acquisition of established brands. Emerson organizes its business into seven segments that sell a wide range of automation software, power tools, and automation hardware such as valves, gauges, and switches. In recent years, Emerson divested its climate technology and consumer businesses to become more of a pure-play industrial automation company. The automation of a factory is an enticing long-term proposition for manufacturers, helping reduce accident rates and raise uptime and productivity.

Emerson Electric's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Emerson Electric's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 12.93%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 21.56%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.69%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Emerson Electric's ROA excels beyond industry benchmarks, reaching 2.22%. This signifies efficient management of assets and strong financial health.

Debt Management: Emerson Electric's debt-to-equity ratio is below the industry average at 0.38, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.