In the last three months, 10 analysts have published ratings on HealthEquity HQY, offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 4 | 0 | 0 | 0 |

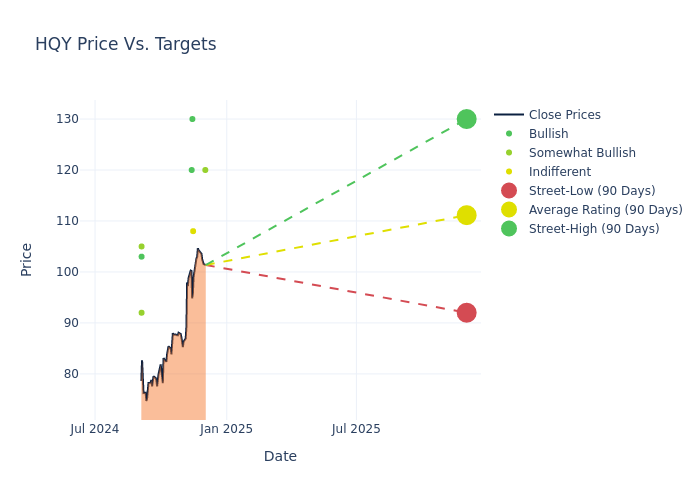

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $108.8, with a high estimate of $130.00 and a low estimate of $92.00. This current average has increased by 5.41% from the previous average price target of $103.22.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive HealthEquity. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexander Paris | Barrington Research | Raises | Outperform | $120.00 | $105.00 |

| David Roman | Goldman Sachs | Announces | Neutral | $108.00 | - |

| David Larsen | BTIG | Raises | Buy | $130.00 | $110.00 |

| Allen Lutz | B of A Securities | Raises | Buy | $120.00 | $100.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $105.00 | $105.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $105.00 | $105.00 |

| George Hill | Deutsche Bank | Raises | Buy | $103.00 | $102.00 |

| Constantine Davides | JMP Securities | Maintains | Market Outperform | $105.00 | $105.00 |

| Sean Dodge | RBC Capital | Maintains | Outperform | $92.00 | $92.00 |

| Allen Lutz | B of A Securities | Lowers | Buy | $100.00 | $105.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to HealthEquity. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of HealthEquity compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into HealthEquity's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on HealthEquity analyst ratings.

Delving into HealthEquity's Background

HealthEquity Inc provides solutions that allow consumers to make healthcare saving and spending decisions. It provides payment processing services, personalized benefit information, the ability to earn wellness incentives, and investment advice to grow their tax-advantaged healthcare savings. It manages consumers' tax-advantaged health savings accounts (HSAs) and other consumer-directed benefits (CDBs) offered by employers, including flexible spending accounts and health reimbursement arrangements (FSAs and HRAs), and administers Consolidated Omnibus Budget Reconciliation Act (COBRA), commuter and other benefits. It also provides investment advisory services to customers whose account balances exceed a certain threshold. HealthEquity generates its revenue in the United States.

HealthEquity's Economic Impact: An Analysis

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: HealthEquity displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 23.15%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: HealthEquity's net margin excels beyond industry benchmarks, reaching 11.94%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): HealthEquity's ROE stands out, surpassing industry averages. With an impressive ROE of 1.68%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.06%, the company showcases effective utilization of assets.

Debt Management: HealthEquity's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.54.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.