Throughout the last three months, 20 analysts have evaluated FedEx FDX, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 9 | 4 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 4 | 8 | 3 | 1 | 0 |

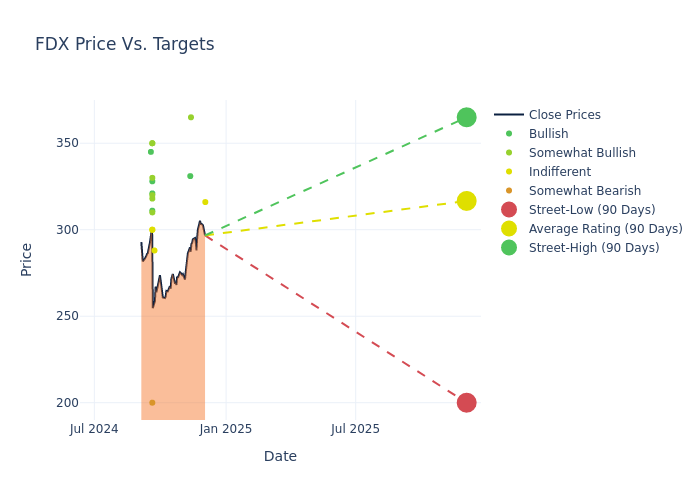

Analysts have recently evaluated FedEx and provided 12-month price targets. The average target is $317.95, accompanied by a high estimate of $365.00 and a low estimate of $200.00. This current average represents a 3.39% decrease from the previous average price target of $329.11.

Understanding Analyst Ratings: A Comprehensive Breakdown

The analysis of recent analyst actions sheds light on the perception of FedEx by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Vernon | Bernstein | Lowers | Market Perform | $316.00 | $337.00 |

| Brandon Oglenski | Barclays | Raises | Overweight | $365.00 | $350.00 |

| Ariel Rosa | Citigroup | Raises | Buy | $331.00 | $301.00 |

| Ariel Rosa | Citigroup | Announces | Buy | $301.00 | - |

| Rick Paterson | Loop Capital | Lowers | Hold | $288.00 | $317.00 |

| Fadi Chamoun | BMO Capital | Lowers | Market Perform | $300.00 | $325.00 |

| Parash Jain | HSBC | Announces | Hold | $300.00 | - |

| Helane Becker | TD Cowen | Lowers | Buy | $328.00 | $334.00 |

| Brian Ossenbeck | JP Morgan | Lowers | Overweight | $350.00 | $359.00 |

| Bascome Majors | Susquehanna | Lowers | Positive | $330.00 | $345.00 |

| J. Bruce Chan | Stifel | Lowers | Buy | $321.00 | $327.00 |

| Daniel Imbro | Stephens & Co. | Maintains | Overweight | $350.00 | $350.00 |

| Thomas Wadewitz | UBS | Lowers | Buy | $311.00 | $333.00 |

| Patrick Tyler Brown | Raymond James | Lowers | Outperform | $310.00 | $330.00 |

| Jonathan Chappell | Evercore ISI Group | Lowers | Outperform | $318.00 | $335.00 |

| Ravi Shanker | Morgan Stanley | Lowers | Underweight | $200.00 | $215.00 |

| Garrett Holland | Baird | Lowers | Outperform | $320.00 | $340.00 |

| Ken Hoexter | B of A Securities | Lowers | Buy | $345.00 | $347.00 |

| Garrett Holland | Baird | Maintains | Outperform | $340.00 | $340.00 |

| Jonathan Chappell | Evercore ISI Group | Lowers | Outperform | $335.00 | $339.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to FedEx. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of FedEx compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of FedEx's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of FedEx's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on FedEx analyst ratings.

Get to Know FedEx Better

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2024, which ended in May, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder came from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting its presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

Breaking Down FedEx's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Negative Revenue Trend: Examining FedEx's financials over 3 months reveals challenges. As of 31 August, 2024, the company experienced a decline of approximately -0.47% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: FedEx's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.67% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): FedEx's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.9%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.91%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.39.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.