During the last three months, 4 analysts shared their evaluations of First BanCorp FBP, revealing diverse outlooks from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

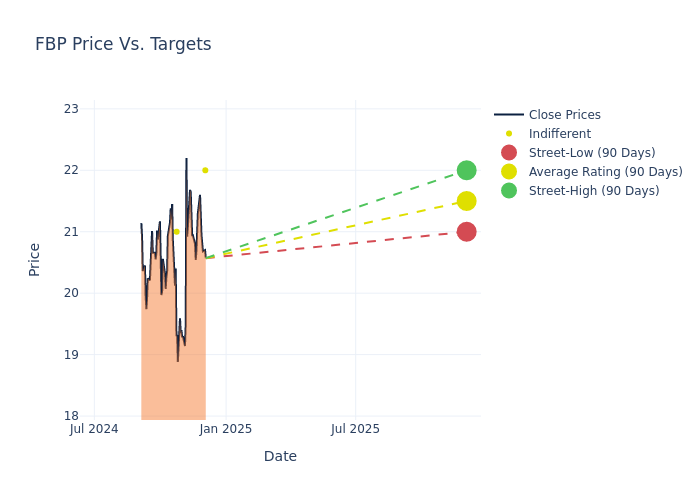

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $21.25, with a high estimate of $22.00 and a low estimate of $20.00. Observing a 1.19% increase, the current average has risen from the previous average price target of $21.00.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of First BanCorp by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Timur Braziler | Wells Fargo | Raises | Equal-Weight | $22.00 | $20.00 |

| Timur Braziler | Wells Fargo | Lowers | Equal-Weight | $20.00 | $22.00 |

| Frank Schiraldi | Piper Sandler | Lowers | Neutral | $21.00 | $22.00 |

| Timur Braziler | Wells Fargo | Raises | Equal-Weight | $22.00 | $20.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to First BanCorp. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of First BanCorp compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for First BanCorp's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

For valuable insights into First BanCorp's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on First BanCorp analyst ratings.

Delving into First BanCorp's Background

First BanCorp is a financial holding company. The company's operating segment includes Commercial and Corporate Banking; Mortgage Banking; Consumer (Retail) Banking; Treasury and Investments; United States Operations; and Virgin Islands Operations. It generates maximum revenue from the Consumer (Retail) Banking segment. The Consumer (Retail) Banking segment generates majority revenue, which consists of the Corporation's consumer lending and deposit-taking activities conducted mainly through its branch network and loan centres. Geographically, it derives a majority of revenue from Puerto Rico.

Financial Milestones: First BanCorp's Journey

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Challenges: First BanCorp's revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -1.09%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: First BanCorp's net margin is impressive, surpassing industry averages. With a net margin of 32.2%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.62%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): First BanCorp's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.39%, the company showcases efficient use of assets and strong financial health.

Debt Management: First BanCorp's debt-to-equity ratio is below the industry average at 0.36, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.