Henry Schein HSIC underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

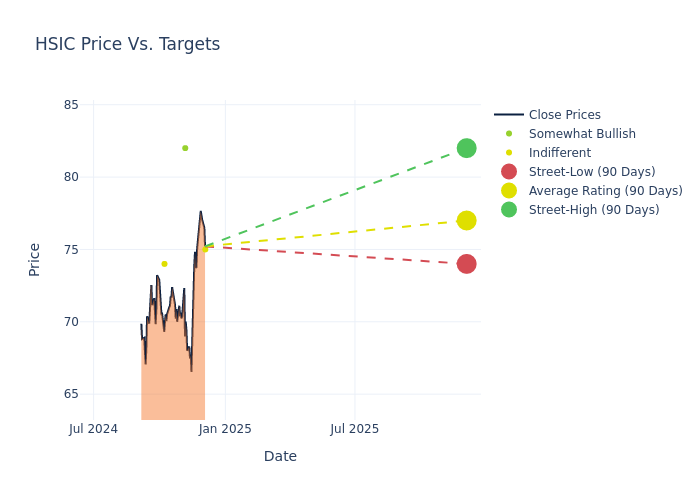

Analysts have set 12-month price targets for Henry Schein, revealing an average target of $78.25, a high estimate of $82.00, and a low estimate of $74.00. This current average reflects an increase of 0.32% from the previous average price target of $78.00.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Henry Schein by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Steven Valiquette | Mizuho | Announces | Neutral | $75.00 | - |

| Michael Petusky | Barrington Research | Maintains | Outperform | $82.00 | $82.00 |

| Ross Muken | Evercore ISI Group | Raises | In-Line | $74.00 | $70.00 |

| Michael Petusky | Barrington Research | Maintains | Outperform | $82.00 | $82.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Henry Schein. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Henry Schein compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Henry Schein's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Henry Schein's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Henry Schein analyst ratings.

Unveiling the Story Behind Henry Schein

Henry Schein Inc is a solutions company for healthcare professionals powered by a network of people and technology. The company is a provider of healthcare products and services primarily to office-based dental and medical practitioners, as well as alternate sites of care. The company operates in two reportable segments; health care distribution and technology & value-added services. The healthcare distribution segment is engaged in combining global dental and medical businesses and distributes consumable products, small equipment, laboratory products, and Vitamins. The technology and value-added services reportable segment provides software, technology & other value-added services to health care practitioners. The majority of revenue is derived from the health care distribution segment.

Understanding the Numbers: Henry Schein's Finances

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Henry Schein's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 0.38%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Henry Schein's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.12% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Henry Schein's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.82% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Henry Schein's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.95%, the company showcases efficient use of assets and strong financial health.

Debt Management: Henry Schein's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.85.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.