Across the recent three months, 4 analysts have shared their insights on Macerich MAC, expressing a variety of opinions spanning from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 2 | 0 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 1 |

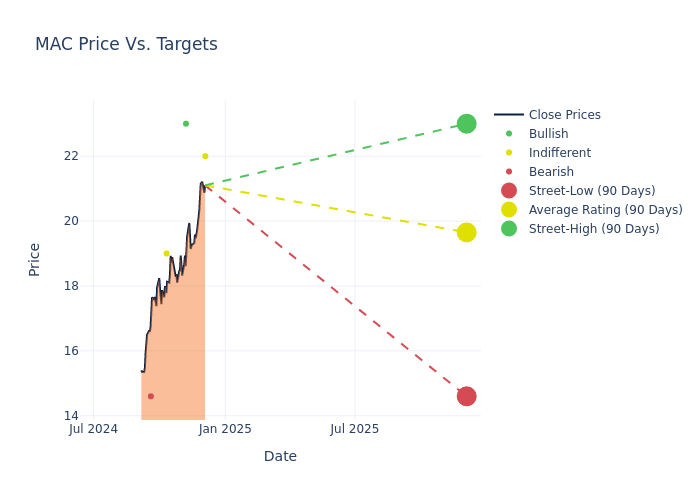

In the assessment of 12-month price targets, analysts unveil insights for Macerich, presenting an average target of $19.65, a high estimate of $23.00, and a low estimate of $14.60. Surpassing the previous average price target of $16.00, the current average has increased by 22.81%.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Macerich among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Haendel St. Juste | Mizuho | Raises | Neutral | $22.00 | $14.00 |

| Floris Van Dijkum | Compass Point | Raises | Buy | $23.00 | $20.00 |

| Jeffrey Spector | B of A Securities | Raises | Neutral | $19.00 | $17.00 |

| Caitlin Burrows | Goldman Sachs | Raises | Sell | $14.60 | $13.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Macerich. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Macerich compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Macerich's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Macerich's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Macerich analyst ratings.

All You Need to Know About Macerich

The Macerich Company invests in premium mall assets. The company owns 28 regional malls in its consolidated portfolio and 14 regional malls in its unconsolidated portfolio along with three power centers and seven other real estate assets. The company's total portfolio has 45.5 million square feet of gross leasable area and averaged $836 sales per square foot over the 12 months ended in December 2023.

Financial Insights: Macerich

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Macerich's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 0.95%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Macerich's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -49.24%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Macerich's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -4.32%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -1.41%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Macerich's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.76.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.