In the last three months, 10 analysts have published ratings on Veeva Systems VEEV, offering a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 6 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 3 | 1 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

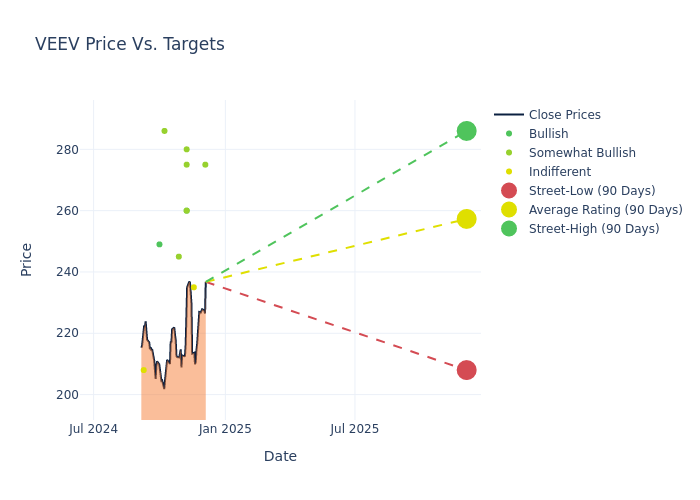

The 12-month price targets, analyzed by analysts, offer insights with an average target of $257.3, a high estimate of $286.00, and a low estimate of $208.00. Witnessing a positive shift, the current average has risen by 8.05% from the previous average price target of $238.14.

Decoding Analyst Ratings: A Detailed Look

The perception of Veeva Systems by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Steven Valiquette | Mizuho | Announces | Outperform | $275.00 | - |

| Allan Verkhovski | Scotiabank | Announces | Sector Perform | $235.00 | - |

| Saket Kalia | Barclays | Raises | Overweight | $260.00 | $240.00 |

| Rishi Jaluria | RBC Capital | Raises | Outperform | $275.00 | $250.00 |

| Ryan MacDonald | Needham | Maintains | Buy | $260.00 | $260.00 |

| Brent Bracelin | Piper Sandler | Raises | Overweight | $280.00 | $230.00 |

| Joe Vruwink | Baird | Lowers | Outperform | $245.00 | $251.00 |

| Andrew DeGasperi | Exane BNP Paribas | Announces | Outperform | $286.00 | - |

| Jack Wallace | Guggenheim | Raises | Buy | $249.00 | $233.00 |

| Anne Samuel | JP Morgan | Raises | Neutral | $208.00 | $203.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Veeva Systems. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Veeva Systems compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Veeva Systems's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Veeva Systems's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Veeva Systems analyst ratings.

Delving into Veeva Systems's Background

Veeva is the global leading supplier of cloud-based software solutions for the life sciences industry. The company's best-of-breed offerings address operating and regulatory requirements for customers ranging from small, emerging biotechnology companies to departments of global pharmaceutical manufacturers. The company leverages its domain expertise to improve the efficiency and compliance of the underserved life sciences industry, displacing large, highly customized and dated enterprise resource planning systems that have limited flexibility. Its two main products are Veeva CRM, a customer relationship management platform for companies with a salesforce, and Veeva Vault, a content management platform that tackles various functions within any life sciences company.

A Deep Dive into Veeva Systems's Financials

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Veeva Systems displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 14.56%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Veeva Systems's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 25.3% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Veeva Systems's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.4%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Veeva Systems's ROA excels beyond industry benchmarks, reaching 2.73%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.