7 analysts have shared their evaluations of Prologis PLD during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

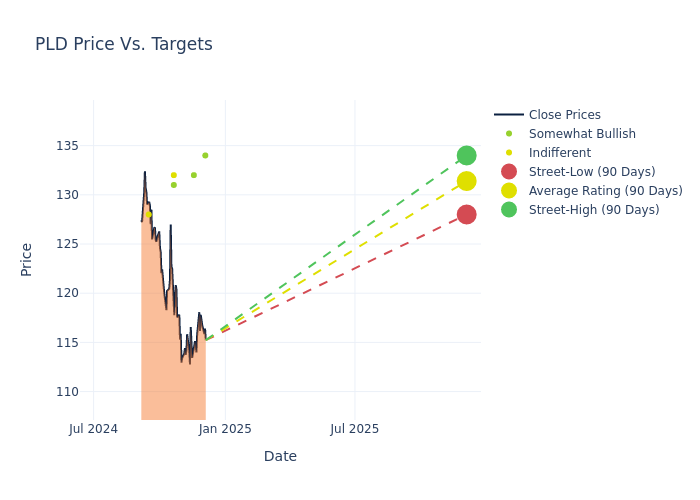

Analysts have set 12-month price targets for Prologis, revealing an average target of $132.0, a high estimate of $136.00, and a low estimate of $128.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 3.25%.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive Prologis. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nicholas Yulico | Scotiabank | Lowers | Sector Outperform | $134.00 | $136.00 |

| Anthony Powell | Barclays | Raises | Overweight | $132.00 | $131.00 |

| Nicholas Yulico | Scotiabank | Lowers | Sector Outperform | $136.00 | $142.00 |

| Michael Mueller | JP Morgan | Lowers | Overweight | $131.00 | $138.00 |

| Caitlin Burrows | Goldman Sachs | Lowers | Neutral | $132.00 | $142.00 |

| Anthony Powell | Barclays | Lowers | Overweight | $131.00 | $142.00 |

| Steve Sakwa | Evercore ISI Group | Raises | In-Line | $128.00 | $124.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Prologis. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Prologis compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Prologis's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Prologis's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Prologis analyst ratings.

Unveiling the Story Behind Prologis

Prologis was formed by the June 2011 merger of AMB Property and Prologis Trust. The company develops, acquires, and operates around 1.2 billion square feet of high-quality industrial and logistics facilities across the globe. The company also has a strategic capital business segment that has around $60 billion of third-party AUM. The company is organized into four global divisions (Americas, Europe, Asia, and other Americas) and operates as a real estate investment trust.

Breaking Down Prologis's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Over the 3 months period, Prologis showcased positive performance, achieving a revenue growth rate of 6.36% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Prologis's net margin is impressive, surpassing industry averages. With a net margin of 49.32%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Prologis's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.89% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Prologis's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.06% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Prologis's debt-to-equity ratio is below the industry average at 0.61, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.