In the last three months, 13 analysts have published ratings on Range Resources RRC, offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 5 | 2 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 4 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 2 | 1 |

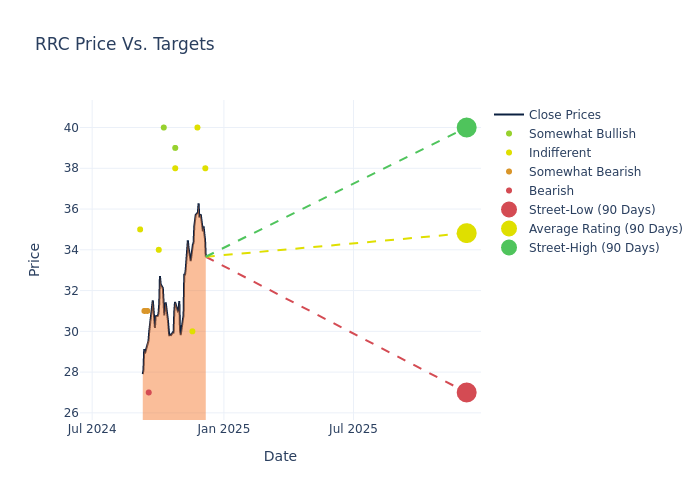

Analysts have recently evaluated Range Resources and provided 12-month price targets. The average target is $35.85, accompanied by a high estimate of $45.00 and a low estimate of $27.00. Observing a downward trend, the current average is 1.46% lower than the prior average price target of $36.38.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Range Resources by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Paul Diamond | Citigroup | Raises | Neutral | $38.00 | $33.00 |

| Scott Hanold | RBC Capital | Raises | Sector Perform | $40.00 | $35.00 |

| Mark Lear | Piper Sandler | Lowers | Neutral | $30.00 | $31.00 |

| Mike Scialla | Stephens & Co. | Raises | Overweight | $39.00 | $37.00 |

| Roger Read | Wells Fargo | Lowers | Equal-Weight | $38.00 | $39.00 |

| Mike Scialla | Stephens & Co. | Raises | Overweight | $37.00 | $36.00 |

| Mike Scialla | Stephens & Co. | Raises | Overweight | $36.00 | $35.00 |

| Nitin Kumar | Mizuho | Lowers | Outperform | $40.00 | $45.00 |

| Betty Jiang | Barclays | Lowers | Equal-Weight | $34.00 | $35.00 |

| Josh Silverstein | UBS | Lowers | Sell | $27.00 | $30.00 |

| Devin McDermott | Morgan Stanley | Lowers | Underweight | $31.00 | $33.00 |

| Nitin Kumar | Mizuho | Lowers | Outperform | $45.00 | $47.00 |

| Arun Jayaram | JP Morgan | Lowers | Underweight | $31.00 | $37.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Range Resources. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Range Resources compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Range Resources's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Range Resources's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Range Resources analyst ratings.

About Range Resources

Fort Worth-based Range Resources is an independent exploration and production company with that focuses entirely on its operations in the Marcellus Shale in Pennsylvania. At year-end 2023, Range Resources' proven reserves totaled 18.1 trillion cubic feet equivalent, with net production of 2.14 billion cubic feet equivalent per day. Natural gas accounted for 69% of production.

A Deep Dive into Range Resources's Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Decline in Revenue: Over the 3 months period, Range Resources faced challenges, resulting in a decline of approximately -0.6% in revenue growth as of 30 September, 2024. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Range Resources's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 8.89%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Range Resources's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.31%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.7%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.47, Range Resources adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.