BigCommerce Holdings BIGC has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

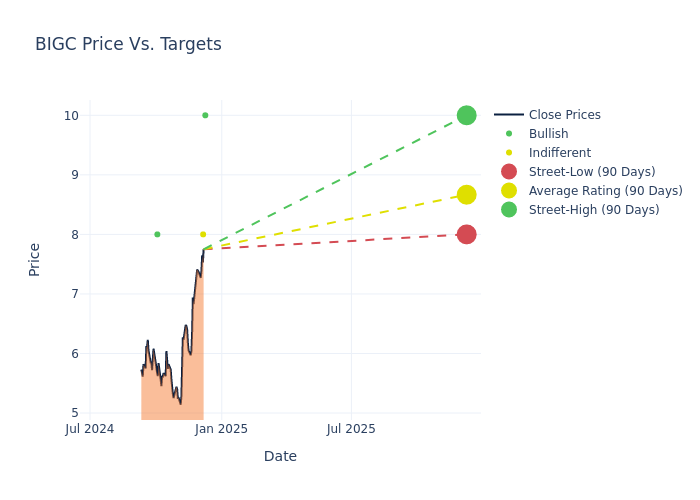

Analysts have set 12-month price targets for BigCommerce Holdings, revealing an average target of $10.0, a high estimate of $14.00, and a low estimate of $8.00. Observing a downward trend, the current average is 2.44% lower than the prior average price target of $10.25.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of BigCommerce Holdings's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Berg | Needham | Maintains | Buy | $10.00 | $10.00 |

| Ramsey El-Assal | Barclays | Raises | Equal-Weight | $8.00 | $7.00 |

| Parker Lane | Stifel | Lowers | Buy | $8.00 | $10.00 |

| Scott Berg | Needham | Maintains | Buy | $14.00 | $14.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to BigCommerce Holdings. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of BigCommerce Holdings compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of BigCommerce Holdings's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on BigCommerce Holdings analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About BigCommerce Holdings

BigCommerce Holdings Inc is engaged in offering Software-as-a-service (SaaS) e-commerce platform. The company's SaaS platform engages in the creation of online stores by delivering a combination of ease-of-use, enterprise functionality, and flexibility. It powers both the customers' branded ecommerce stores and their cross-channel connections to popular online marketplaces, social networks, and offline point-of-sale systems. The group operates in a single segment covering geographical areas of Americas-U.S.; Americas-other; EMEA; and APAC, of which majority of revenue is generated from Americas-U.S.

A Deep Dive into BigCommerce Holdings's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Positive Revenue Trend: Examining BigCommerce Holdings's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.26% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: BigCommerce Holdings's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -8.35% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): BigCommerce Holdings's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -25.38%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -1.78%, the company showcases effective utilization of assets.

Debt Management: BigCommerce Holdings's debt-to-equity ratio is notably higher than the industry average. With a ratio of 7.65, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.