8 analysts have expressed a variety of opinions on Wendy's WEN over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 5 | 0 | 0 |

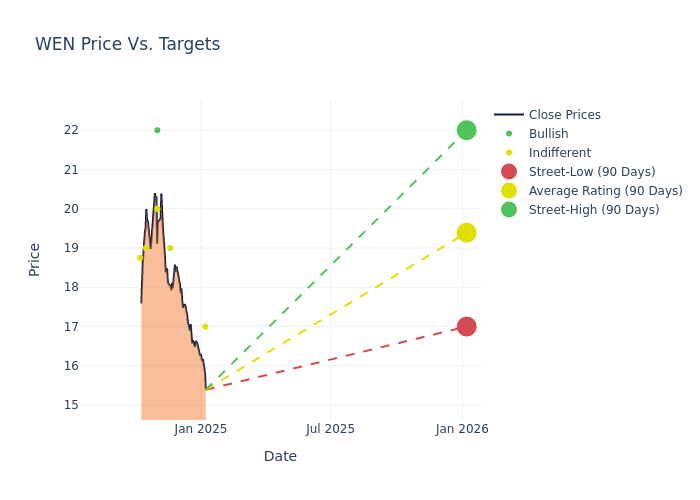

Analysts have recently evaluated Wendy's and provided 12-month price targets. The average target is $19.38, accompanied by a high estimate of $22.00 and a low estimate of $17.00. Observing a 0.68% increase, the current average has risen from the previous average price target of $19.25.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Wendy's's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dennis Geiger | UBS | Lowers | Neutral | $17.00 | $20.00 |

| Jim Salera | Stephens & Co. | Maintains | Equal-Weight | $19.00 | $19.00 |

| Andrew Strelzik | BMO Capital | Raises | Market Perform | $20.00 | $19.00 |

| Jake Bartlett | Truist Securities | Raises | Buy | $22.00 | $21.00 |

| Nick Setyan | Wedbush | Maintains | Neutral | $20.00 | $20.00 |

| Jim Salera | Stephens & Co. | Maintains | Equal-Weight | $19.00 | $19.00 |

| Jim Salera | Stephens & Co. | Maintains | Equal-Weight | $19.00 | $19.00 |

| Andrew Charles | TD Cowen | Raises | Hold | $19.00 | $17.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Wendy's. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Wendy's compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Wendy's's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Wendy's's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Wendy's analyst ratings.

Get to Know Wendy's Better

The Wendy's Company is the second-largest burger quick-service restaurant, or QSR, chain in the United States by systemwide sales, with $12.3 billion in 2023, narrowly edging Burger King ($11.5 billion) and clocking in well behind wide-moat McDonald's ($53.1 billion). After divestitures of Tim Hortons (2006) and Arby's (2011), the firm manages just the burger banner, generating sales across a footprint that spanned almost 7,157 total stores in 30 countries as of year-end 2023. Wendy's generates revenue from the sale of hamburgers, chicken sandwiches, salads, and fries throughout its company-owned footprint, through franchise royalty and marketing fund payments remitted by its franchisees, which account for 94% of stores, and through franchise flipping and advisory fees.

Wendy's: Delving into Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Wendy's's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 2.94%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Wendy's's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.86% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Wendy's's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 18.82% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Wendy's's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.99%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Wendy's's debt-to-equity ratio is notably higher than the industry average. With a ratio of 15.77, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.