Throughout the last three months, 7 analysts have evaluated Bread Finl Hldgs BFH, offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 2 | 1 | 1 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 1 | 1 |

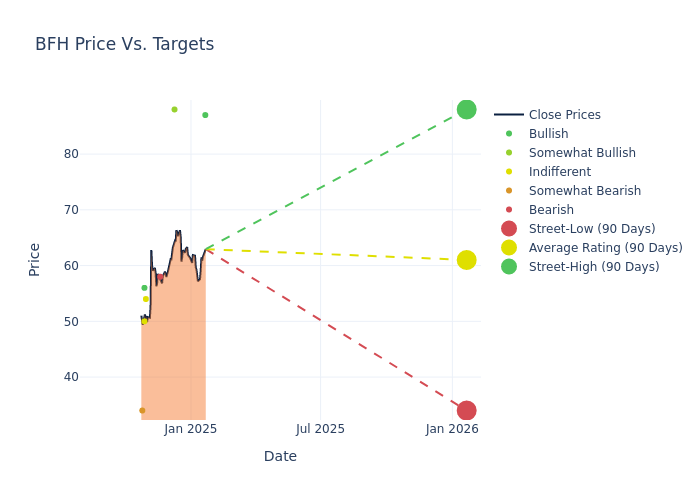

Analysts have set 12-month price targets for Bread Finl Hldgs, revealing an average target of $61.0, a high estimate of $88.00, and a low estimate of $34.00. Witnessing a positive shift, the current average has risen by 10.33% from the previous average price target of $55.29.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Bread Finl Hldgs. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Rochester | Compass Point | Raises | Buy | $87.00 | $75.00 |

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Raises | Outperform | $88.00 | $67.00 |

| Ryan Nash | Goldman Sachs | Raises | Sell | $58.00 | $52.00 |

| John Pancari | Evercore ISI Group | Raises | In-Line | $54.00 | $52.00 |

| Bill Ryan | Seaport Global | Lowers | Buy | $56.00 | $58.00 |

| Moshe Orenbuch | TD Cowen | Raises | Hold | $50.00 | $48.00 |

| Terry Ma | Barclays | Lowers | Underweight | $34.00 | $35.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Bread Finl Hldgs. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Bread Finl Hldgs compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Bread Finl Hldgs's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

For valuable insights into Bread Finl Hldgs's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Bread Finl Hldgs analyst ratings.

Get to Know Bread Finl Hldgs Better

Formed by a combination of JCPenney's credit card processing unit and The Limited's credit card bank business, Bread Financial is a provider of private label and co-branded credit cards, loyalty programs, and marketing services. The company's most financially significant unit is its credit card business that partners with retailers to jointly market Bread's credit cards to their customers. The company also retains minority interest in its recently spun-off LoyaltyOne division, which operates the largest airline miles loyalty program in Canada and offers marketing services to grocery chains in Europe and Asia.

Financial Insights: Bread Finl Hldgs

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: Bread Finl Hldgs's revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -4.66%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Bread Finl Hldgs's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 0.2%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Bread Finl Hldgs's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.06%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Bread Finl Hldgs's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.01%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Bread Finl Hldgs's debt-to-equity ratio is below the industry average at 1.47, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.