New Oriental Education EDU underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 3 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

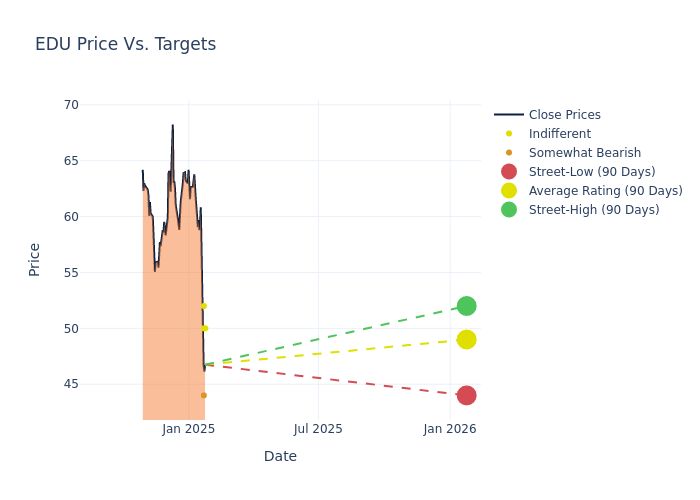

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $49.0, a high estimate of $52.00, and a low estimate of $44.00. Highlighting a 40.61% decrease, the current average has fallen from the previous average price target of $82.50.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of New Oriental Education by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michelle Fang | Citigroup | Lowers | Neutral | $50.00 | $83.00 |

| Eddy Wang | Morgan Stanley | Lowers | Equal-Weight | $52.00 | $83.00 |

| Linda Huang | Macquarie | Lowers | Underperform | $44.00 | $79.00 |

| DS Kim | JP Morgan | Lowers | Neutral | $50.00 | $85.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to New Oriental Education. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of New Oriental Education compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of New Oriental Education's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into New Oriental Education's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on New Oriental Education analyst ratings.

Discovering New Oriental Education: A Closer Look

New Oriental is a prominent private education provider in China, offering a wide array of educational services. These include overseas test preparation, consulting services, high school academic tutoring, nonacademic tutoring, and intelligent learning systems and devices. Additionally, the company holds a 57% ownership stake in East Buy, a leading player in the livestreaming e-commerce market.

New Oriental Education: Delving into Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3 months period, New Oriental Education showcased positive performance, achieving a revenue growth rate of 19.44% as of 30 November, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: New Oriental Education's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 3.07%, the company may face hurdles in effective cost management.

Return on Equity (ROE): New Oriental Education's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.83%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): New Oriental Education's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.42%, the company may face hurdles in achieving optimal financial returns.

Debt Management: New Oriental Education's debt-to-equity ratio is below the industry average. With a ratio of 0.2, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.