During the last three months, 4 analysts shared their evaluations of AMETEK AME, revealing diverse outlooks from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

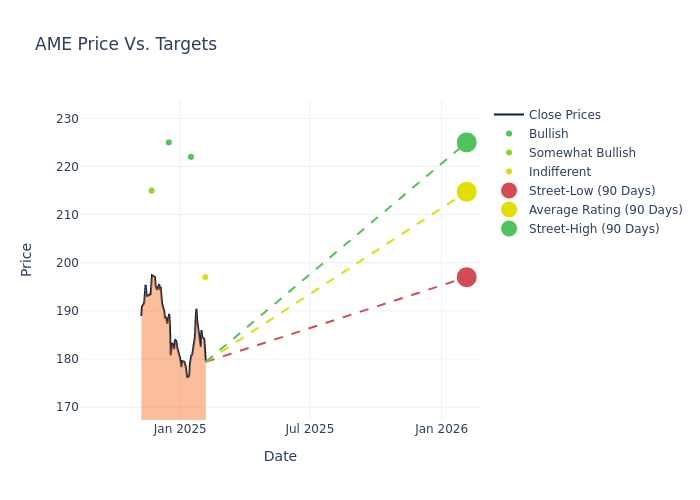

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $214.75, a high estimate of $225.00, and a low estimate of $197.00. Surpassing the previous average price target of $205.25, the current average has increased by 4.63%.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive AMETEK is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Eastman | Baird | Lowers | Neutral | $197.00 | $200.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $222.00 | $221.00 |

| Andrew Obin | B of A Securities | Raises | Buy | $225.00 | $195.00 |

| Steve Barger | Keybanc | Raises | Overweight | $215.00 | $205.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to AMETEK. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of AMETEK compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for AMETEK's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of AMETEK's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on AMETEK analyst ratings.

Get to Know AMETEK Better

Founded in 1930 and transformed over the decades through the acquisition of dozens of esteemed brands, Ametek owns a collection of over 40 autonomous industrial businesses operating within the research, aerospace, energy, medical, and manufacturing industries. Ametek segments its business into two operating groups: the electronic instruments group (EIG) and electromechanical group (EMG). EIG sells a broad portfolio of analytical, test, and measurement instruments, while EMG sells highly engineered components, interconnects, and specialty metals. The company emphasizes product differentiation and market leadership in the niche markets where it operates.

Financial Insights: AMETEK

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: AMETEK's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 5.28%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 19.91%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): AMETEK's ROE stands out, surpassing industry averages. With an impressive ROE of 3.62%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): AMETEK's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.3%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.24, AMETEK adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.