Ratings for Mach Natural Resources MNR were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

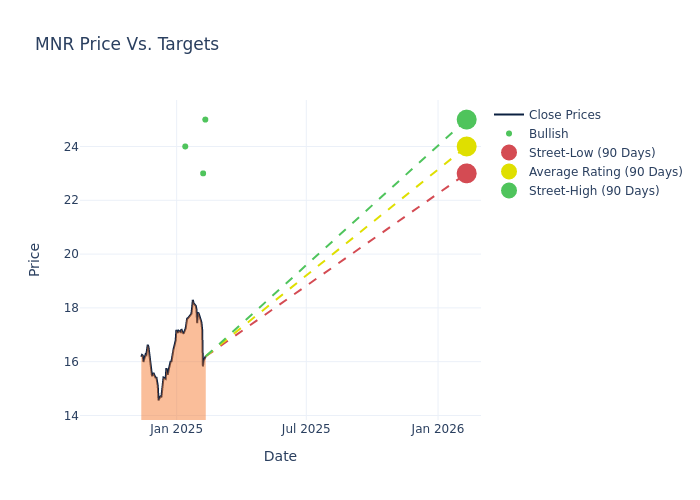

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $23.75, a high estimate of $25.00, and a low estimate of $23.00. Observing a 6.36% increase, the current average has risen from the previous average price target of $22.33.

Diving into Analyst Ratings: An In-Depth Exploration

A comprehensive examination of how financial experts perceive Mach Natural Resources is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Freeman | Raymond James | Raises | Strong Buy | $25.00 | $23.00 |

| Selman Akyol | Stifel | Raises | Buy | $23.00 | $21.00 |

| Neal Dingmann | Truist Securities | Raises | Buy | $24.00 | $23.00 |

| Neal Dingmann | Truist Securities | Announces | Buy | $23.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Mach Natural Resources. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Mach Natural Resources compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Mach Natural Resources's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Mach Natural Resources's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Mach Natural Resources analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind Mach Natural Resources

Mach Natural Resources LP is an independent upstream oil and gas company focused on the acquisition, development and production of oil, natural gas and NGL reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas and the panhandle of Texas.

A Deep Dive into Mach Natural Resources's Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Mach Natural Resources displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 45.7%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Net Margin: Mach Natural Resources's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 26.39% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Mach Natural Resources's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 5.77%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Mach Natural Resources's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 2.96%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Mach Natural Resources's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.64, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.