5 analysts have shared their evaluations of Waystar Holding WAY during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

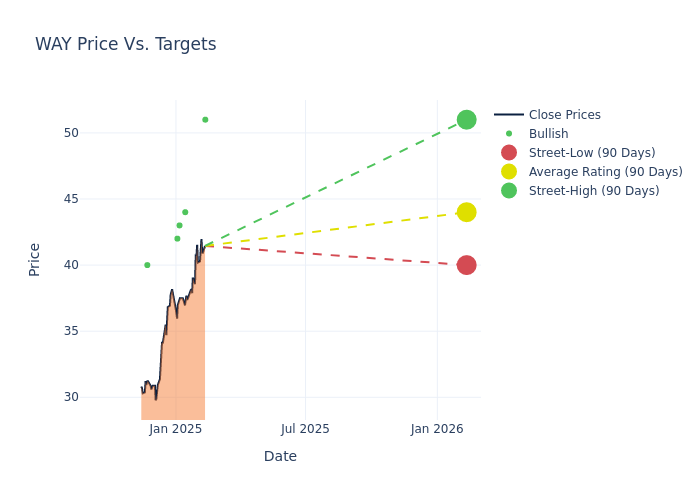

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $44.0, along with a high estimate of $51.00 and a low estimate of $40.00. This upward trend is evident, with the current average reflecting a 16.56% increase from the previous average price target of $37.75.

Investigating Analyst Ratings: An Elaborate Study

An in-depth analysis of recent analyst actions unveils how financial experts perceive Waystar Holding. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Glen Santangelo | Jefferies | Announces | Buy | $51.00 | - |

| Adam Hotchkiss | Goldman Sachs | Raises | Buy | $44.00 | $39.00 |

| Allen Lutz | B of A Securities | Raises | Buy | $43.00 | $36.00 |

| Richard Close | Canaccord Genuity | Raises | Buy | $42.00 | $36.00 |

| Brian Peterson | Raymond James | Maintains | Strong Buy | $40.00 | $40.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Waystar Holding. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Waystar Holding compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Waystar Holding's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Waystar Holding's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Waystar Holding analyst ratings.

All You Need to Know About Waystar Holding

Waystar Holding Corp is a provider of mission-critical cloud technology to healthcare organizations. its enterprise-grade platform transforms the complex and disparate processes comprising healthcare payments received by healthcare providers from payers and patients, from pre-service engagement through post-service remittance and reconciliation. its platform enhances data integrity, eliminates manual tasks, and improves claim and billing accuracy, which results in better transparency, reduced labor costs, and faster, more accurate reimbursement and cash flow. The market for our solutions extends throughout the United States and includes Puerto Rico and other US Territories.

A Deep Dive into Waystar Holding's Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Waystar Holding's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 21.72%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Waystar Holding's net margin excels beyond industry benchmarks, reaching 2.25%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Waystar Holding's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.18% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Waystar Holding's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.12%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.41.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.