Across the recent three months, 4 analysts have shared their insights on United Natural Foods UNFI, expressing a variety of opinions spanning from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 3 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

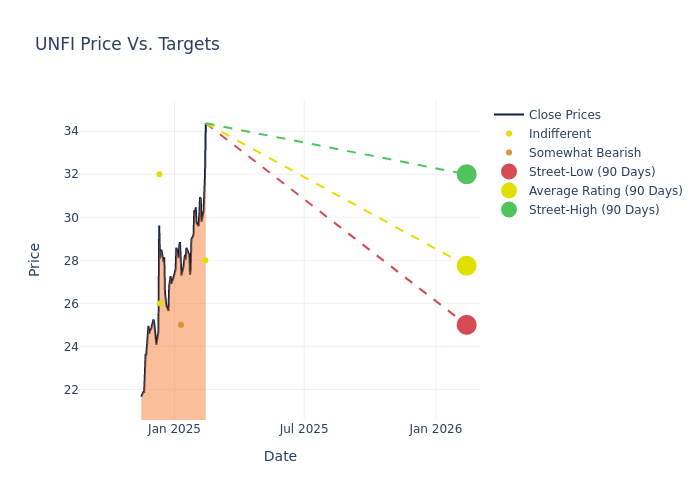

In the assessment of 12-month price targets, analysts unveil insights for United Natural Foods, presenting an average target of $27.75, a high estimate of $32.00, and a low estimate of $25.00. This upward trend is evident, with the current average reflecting a 21.98% increase from the previous average price target of $22.75.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of United Natural Foods among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Leah Jordan | Goldman Sachs | Raises | Neutral | $28.00 | $25.00 |

| Edward Kelly | Wells Fargo | Raises | Underweight | $25.00 | $23.00 |

| Bill Kirk | Roth MKM | Raises | Neutral | $26.00 | $20.00 |

| Kelly Bania | BMO Capital | Raises | Market Perform | $32.00 | $23.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to United Natural Foods. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of United Natural Foods compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of United Natural Foods's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of United Natural Foods's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on United Natural Foods analyst ratings.

Delving into United Natural Foods's Background

United Natural Foods Inc is a wholesale distributor of natural, organic and specialty foods and nonfood products across North America. The company's products consist of national, regional and private label brands grouped into grocery and general merchandise, produce, perishables and frozen foods, nutritional supplements and sports nutrition, bulk and foodservice products, and personal care items. United Natural Foods serves various retail formats including conventional supermarket chains, natural product superstores, independent retail operators and foodservice channels such as e-commerce platforms. The company's operations are comprised of principal divisions: the wholesale division; the retail division; and other.

Financial Insights: United Natural Foods

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, United Natural Foods showcased positive performance, achieving a revenue growth rate of 4.22% as of 31 October, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: United Natural Foods's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -0.27%, the company may face hurdles in effective cost management.

Return on Equity (ROE): United Natural Foods's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -1.29%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): United Natural Foods's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.27%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: United Natural Foods's debt-to-equity ratio stands notably higher than the industry average, reaching 2.36. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.