5 analysts have shared their evaluations of MercadoLibre MELI during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

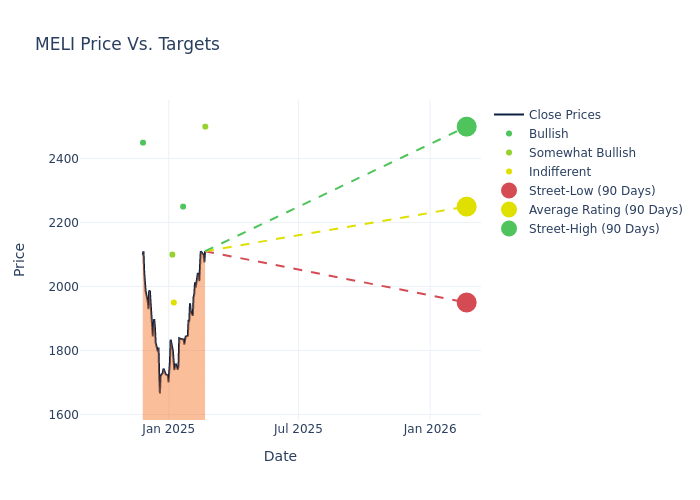

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $2250.0, a high estimate of $2500.00, and a low estimate of $1950.00. A decline of 0.27% from the prior average price target is evident in the current average.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive MercadoLibre is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Trevor Young | Barclays | Raises | Overweight | $2500.00 | $2200.00 |

| Josh Beck | Raymond James | Maintains | Strong Buy | $2250.00 | $2250.00 |

| Marcelo Santos | JP Morgan | Lowers | Neutral | $1950.00 | $2150.00 |

| Scott Devitt | Wedbush | Lowers | Outperform | $2100.00 | $2200.00 |

| Tobias Stingelin | Citigroup | Lowers | Buy | $2450.00 | $2480.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to MercadoLibre. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of MercadoLibre compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of MercadoLibre's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of MercadoLibre's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on MercadoLibre analyst ratings.

Get to Know MercadoLibre Better

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Financial Insights: MercadoLibre

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: MercadoLibre displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 35.27%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: MercadoLibre's net margin is impressive, surpassing industry averages. With a net margin of 7.47%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): MercadoLibre's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.37% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): MercadoLibre's ROA stands out, surpassing industry averages. With an impressive ROA of 1.86%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 1.58, MercadoLibre adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.