During the last three months, 8 analysts shared their evaluations of NVIDIA NVDA, revealing diverse outlooks from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 3 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

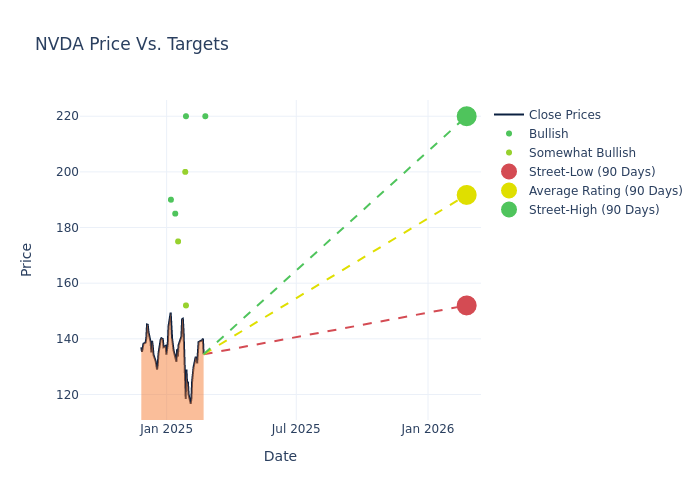

The 12-month price targets, analyzed by analysts, offer insights with an average target of $195.25, a high estimate of $220.00, and a low estimate of $152.00. This upward trend is apparent, with the current average reflecting a 2.7% increase from the previous average price target of $190.12.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive NVIDIA is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Hans Mosesmann | Rosenblatt | Maintains | Buy | $220.00 | $220.00 |

| Joseph Moore | Morgan Stanley | Lowers | Overweight | $152.00 | $166.00 |

| Ivan Feinseth | Tigress Financial | Raises | Strong Buy | $220.00 | $170.00 |

| C J Muse | Cantor Fitzgerald | Maintains | Overweight | $200.00 | $200.00 |

| Blayne Curtis | Barclays | Raises | Overweight | $175.00 | $160.00 |

| Frank Lee | HSBC | Lowers | Buy | $185.00 | $195.00 |

| Hans Mosesmann | Rosenblatt | Maintains | Buy | $220.00 | $220.00 |

| Cody Acree | Benchmark | Maintains | Buy | $190.00 | $190.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to NVIDIA. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of NVIDIA compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of NVIDIA's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into NVIDIA's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on NVIDIA analyst ratings.

Delving into NVIDIA's Background

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

Understanding the Numbers: NVIDIA's Finances

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: NVIDIA displayed positive results in 3 months. As of 31 October, 2024, the company achieved a solid revenue growth rate of approximately 93.61%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: NVIDIA's net margin is impressive, surpassing industry averages. With a net margin of 55.04%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 31.13%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): NVIDIA's ROA stands out, surpassing industry averages. With an impressive ROA of 21.31%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: NVIDIA's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.16.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.