During the last three months, 8 analysts shared their evaluations of Cousins Props CUZ, revealing diverse outlooks from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

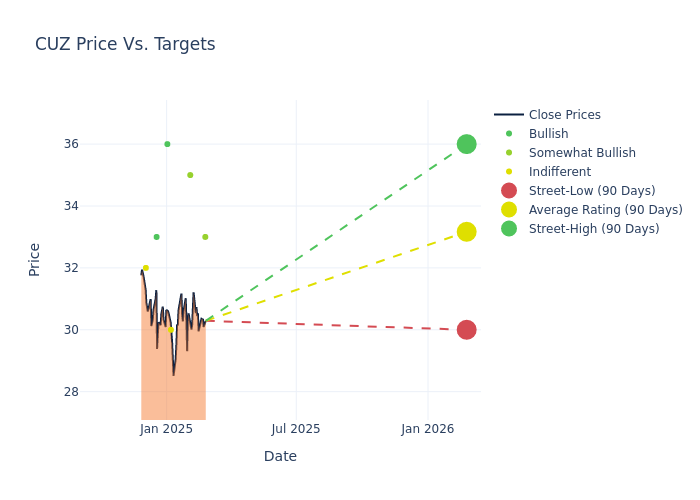

Insights from analysts' 12-month price targets are revealed, presenting an average target of $33.62, a high estimate of $36.00, and a low estimate of $30.00. This upward trend is evident, with the current average reflecting a 5.89% increase from the previous average price target of $31.75.

Exploring Analyst Ratings: An In-Depth Overview

The analysis of recent analyst actions sheds light on the perception of Cousins Props by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Rodgers | Baird | Lowers | Outperform | $33.00 | $34.00 |

| Anthony Powell | Barclays | Lowers | Overweight | $35.00 | $36.00 |

| Anthony Powell | Barclays | Raises | Overweight | $36.00 | $35.00 |

| Vikram Malhotra | Mizuho | Raises | Neutral | $30.00 | $22.00 |

| Peter Abramowitz | Jefferies | Raises | Buy | $36.00 | $33.00 |

| Michael Lewis | Truist Securities | Raises | Buy | $33.00 | $30.00 |

| David Rodgers | Baird | Raises | Outperform | $34.00 | $33.00 |

| John Kim | BMO Capital | Raises | Market Perform | $32.00 | $31.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Cousins Props. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Cousins Props compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Cousins Props's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Cousins Props's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Cousins Props analyst ratings.

Unveiling the Story Behind Cousins Props

Cousins Properties Inc is a real estate investment trust principally involved in the ownership, management, and development of properties in the Southern United States. Cousins Properties' real estate portfolio mainly comprises offices and mixed-use developments that encompass both apartment and retail space. Offices make up the vast majority of the portfolio in terms of total square footage. The segments operates in following geographical areas: Atlanta, Austin, Charlotte, Dallas, Phoenix, Tampa, and other markets. The company derives nearly all of its revenue in the form of rental income from its properties, the majority of which comes from its office locations. A diverse set of tenants in the cities of Houston and Atlanta represent the company's key markets.

Financial Insights: Cousins Props

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Cousins Props displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 14.39%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 6.05%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Cousins Props's ROE stands out, surpassing industry averages. With an impressive ROE of 0.29%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Cousins Props's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.16% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.65, Cousins Props adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.