In the latest quarter, 9 analysts provided ratings for NICE NICE, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 3 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

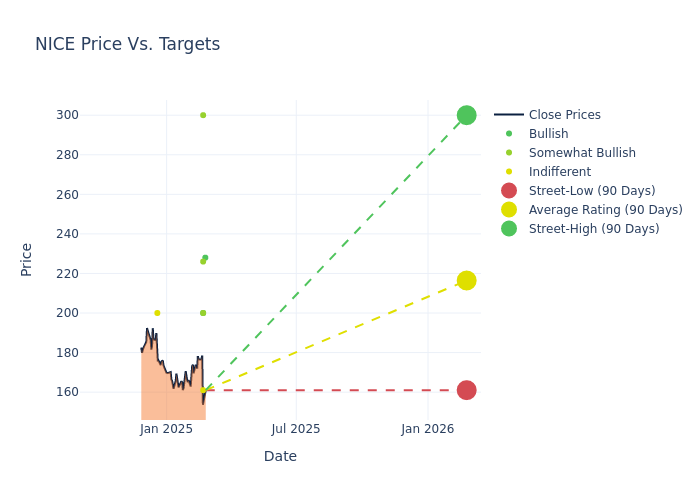

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $218.89, a high estimate of $300.00, and a low estimate of $161.00. A decline of 14.83% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of NICE by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tyler Radke | Citigroup | Lowers | Buy | $228.00 | $279.00 |

| Rishi Jaluria | RBC Capital | Lowers | Outperform | $200.00 | $260.00 |

| Thomas Blakey | Cantor Fitzgerald | Lowers | Neutral | $161.00 | $176.00 |

| Patrick Walravens | Citizens Capital Markets | Maintains | Market Outperform | $300.00 | $300.00 |

| Catharine Trebnick | Rosenblatt | Lowers | Buy | $200.00 | $225.00 |

| Tavy Rosner | Barclays | Lowers | Overweight | $226.00 | $286.00 |

| Tyler Radke | Citigroup | Lowers | Buy | $279.00 | $315.00 |

| Thomas Blakey | Cantor Fitzgerald | Announces | Neutral | $176.00 | - |

| Samad Samana | Jefferies | Lowers | Hold | $200.00 | $215.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to NICE. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of NICE compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of NICE's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of NICE's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on NICE analyst ratings.

Delving into NICE's Background

Nice is an enterprise software company that serves the customer engagement and financial crime and compliance markets. The company provides data analytics-based solutions through both a cloud platform and on-premises infrastructure. Within customer engagement, Nice's CXone platform delivers solutions focused on contact center software and workforce engagement management, or WEM. Contact center offerings include solutions for digital self-service, customer journey and experience optimization, and compliance. WEM products optimize call center efficiency, leveraging data and AI analytics for call volume forecasting and agent scheduling. Within financial crime and compliance, Nice offers risk and investigation management, fraud prevention, anti-money laundering, and compliance solutions.

Financial Milestones: NICE's Journey

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: NICE displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 4.59%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: NICE's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 13.79%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.78%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 1.9%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: NICE's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.16.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.