AGCO AGCO has been analyzed by 8 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 1 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

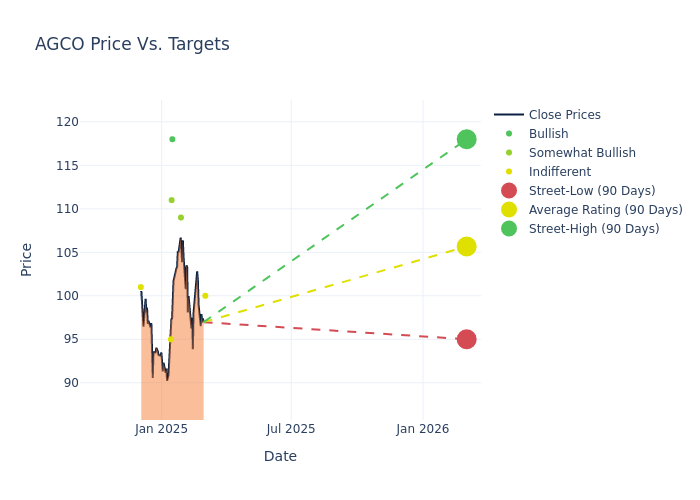

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $107.25, a high estimate of $118.00, and a low estimate of $95.00. This current average reflects an increase of 0.23% from the previous average price target of $107.00.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive AGCO. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mircea Dobre | Baird | Lowers | Neutral | $100.00 | $116.00 |

| Kristen Owen | Oppenheimer | Raises | Outperform | $109.00 | $108.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $118.00 | $109.00 |

| Ann Duignan | JP Morgan | Raises | Overweight | $111.00 | $102.00 |

| Kyle Menges | Citigroup | Lowers | Neutral | $95.00 | $100.00 |

| Jamie Cook | Truist Securities | Lowers | Buy | $109.00 | $116.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $116.00 | $110.00 |

| Kyle Menges | Citigroup | Raises | Neutral | $100.00 | $95.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to AGCO. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of AGCO compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for AGCO's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of AGCO's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on AGCO analyst ratings.

Get to Know AGCO Better

Agco is a global manufacturer of agricultural equipment. Its main machine brands are Fendt, Massey Ferguson, and Valtra; its initiatives in precision agriculture have been organized under the PTx umbrella following a series of acquisitions. While a global business, Agco's sales skew heavily toward Europe/Middle East, representing 50%-60% of sales and even more of operating profits. The company is trying to increase its exposure to the larger North and South American markets. Its products are available through a global dealer network, which includes over 3,000 dealer and distribution locations and reach into over 140 countries. Additionally, Agco offers retail and wholesale financing to customers through its unconsolidated joint venture with Rabobank of the Netherlands.

AGCO: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: AGCO's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -24.03%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: AGCO's net margin is impressive, surpassing industry averages. With a net margin of -8.86%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): AGCO's ROE stands out, surpassing industry averages. With an impressive ROE of -6.48%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): AGCO's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -2.07% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.74.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.