During the last three months, 22 analysts shared their evaluations of Royal Caribbean Gr RCL, revealing diverse outlooks from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 10 | 9 | 3 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 2 | 0 | 0 |

| 2M Ago | 4 | 7 | 1 | 0 | 0 |

| 3M Ago | 3 | 1 | 0 | 0 | 0 |

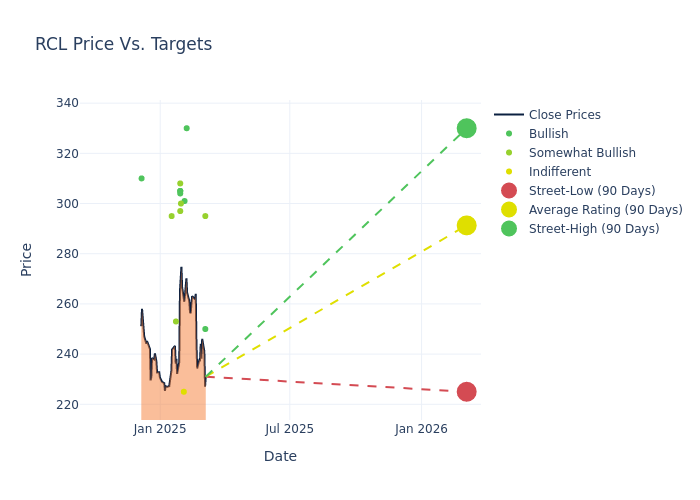

Analysts have set 12-month price targets for Royal Caribbean Gr, revealing an average target of $283.18, a high estimate of $330.00, and a low estimate of $210.00. Observing a 10.23% increase, the current average has risen from the previous average price target of $256.90.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Royal Caribbean Gr. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Laura Champine | Loop Capital | Maintains | Buy | $250.00 | $250.00 |

| Christopher Stathoulopoulos | Susquehanna | Lowers | Positive | $295.00 | $305.00 |

| Ivan Feinseth | Tigress Financial | Raises | Buy | $330.00 | $270.00 |

| Laura Champine | Loop Capital | Announces | Hold | $250.00 | - |

| Robin Farley | UBS | Raises | Buy | $301.00 | $271.00 |

| Jamie Rollo | Morgan Stanley | Raises | Equal-Weight | $225.00 | $210.00 |

| Paul Golding | Macquarie | Raises | Outperform | $300.00 | $250.00 |

| Lizzie Dove | Goldman Sachs | Raises | Buy | $305.00 | $270.00 |

| Christopher Stathoulopoulos | Susquehanna | Raises | Positive | $305.00 | $245.00 |

| John Staszak | Argus Research | Raises | Buy | $305.00 | $280.00 |

| James Hardiman | Citigroup | Raises | Buy | $304.00 | $283.00 |

| Daniel Politzer | Wells Fargo | Raises | Overweight | $297.00 | $272.00 |

| Brandt Montour | Barclays | Raises | Overweight | $308.00 | $287.00 |

| Daniel Politzer | Wells Fargo | Raises | Overweight | $272.00 | $232.00 |

| Lizzie Dove | Goldman Sachs | Lowers | Buy | $270.00 | $275.00 |

| Ben Chaiken | Mizuho | Lowers | Outperform | $253.00 | $255.00 |

| Matthew Boss | JP Morgan | Raises | Overweight | $295.00 | $253.00 |

| Jamie Rollo | Morgan Stanley | Raises | Equal-Weight | $210.00 | $190.00 |

| Brandt Montour | Barclays | Raises | Overweight | $287.00 | $245.00 |

| James Hardiman | Citigroup | Raises | Buy | $283.00 | $257.00 |

| Lizzie Dove | Goldman Sachs | Raises | Buy | $275.00 | $245.00 |

| Steven Wieczynski | Stifel | Raises | Buy | $310.00 | $250.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Royal Caribbean Gr. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Royal Caribbean Gr compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Royal Caribbean Gr's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Royal Caribbean Gr's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Royal Caribbean Gr analyst ratings.

Delving into Royal Caribbean Gr's Background

Royal Caribbean is the world's second-largest cruise company, operating 66 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021 and plans to launch its new Celebrity River Cruise brand in 2027.

Royal Caribbean Gr: Delving into Financials

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Royal Caribbean Gr's remarkable performance in 3 months is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 12.91%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 14.68%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Royal Caribbean Gr's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.56%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.49%, the company showcases effective utilization of assets.

Debt Management: Royal Caribbean Gr's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.75, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.