Providing a diverse range of perspectives from bullish to bearish, 14 analysts have published ratings on Mid-America Apartment MAA in the last three months.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 8 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 2 | 0 | 0 |

| 2M Ago | 0 | 3 | 4 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

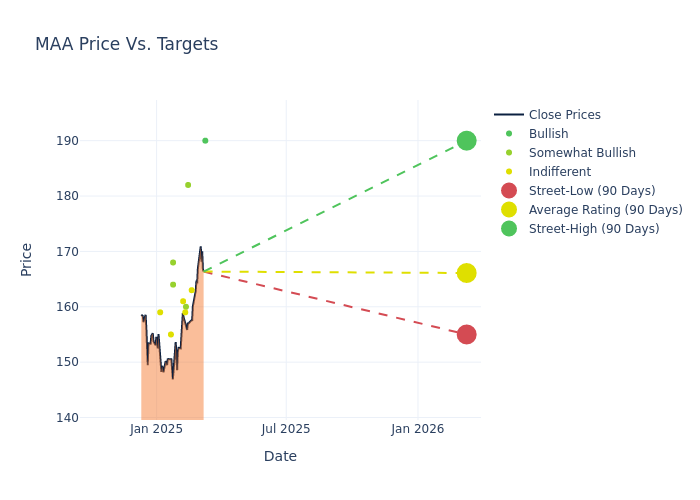

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $163.86, a high estimate of $190.00, and a low estimate of $152.00. Observing a 2.12% increase, the current average has risen from the previous average price target of $160.46.

Investigating Analyst Ratings: An Elaborate Study

In examining recent analyst actions, we gain insights into how financial experts perceive Mid-America Apartment. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Linda Tsai | Jefferies | Raises | Buy | $190.00 | $148.00 |

| Richard Hightower | Barclays | Raises | Equal-Weight | $163.00 | $152.00 |

| Nicholas Yulico | Scotiabank | Raises | Sector Outperform | $182.00 | $173.00 |

| Aaron Hecht | JMP Securities | Maintains | Market Outperform | $160.00 | $160.00 |

| Steve Sakwa | Evercore ISI Group | Raises | In-Line | $159.00 | $155.00 |

| Brad Heffern | RBC Capital | Raises | Sector Perform | $161.00 | $158.00 |

| James Feldman | Wells Fargo | Lowers | Overweight | $164.00 | $174.00 |

| Richard Hightower | Barclays | Lowers | Equal-Weight | $152.00 | $166.00 |

| Adam Kramer | Morgan Stanley | Raises | Overweight | $168.00 | $159.50 |

| Steve Sakwa | Evercore ISI Group | Announces | In-Line | $155.00 | - |

| John Kim | BMO Capital | Lowers | Market Perform | $155.00 | $157.00 |

| Aaron Hecht | JMP Securities | Maintains | Market Outperform | $160.00 | $160.00 |

| Vikram Malhotra | Mizuho | Lowers | Neutral | $159.00 | $163.00 |

| Richard Hightower | Barclays | Announces | Equal-Weight | $166.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Mid-America Apartment. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Mid-America Apartment compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Mid-America Apartment's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Mid-America Apartment's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Mid-America Apartment analyst ratings.

All You Need to Know About Mid-America Apartment

Mid-America Apartment Communities Inc or MAA, is a real estate investment trust engaged in the acquisition, operation, and development of multifamily apartment communities located in the southeastern and southwestern United States. The company operates two reportable segments; Same Store includes communities that the Company has owned and have been stabilized for at least a full 12 months as of the first day of the calendar year and Non-Same Store and Other includes recently acquired communities, communities being developed or in lease-up, communities that have been disposed of or identified for disposition, communities that have experienced a casualty loss and stabilized communities that do not meet the requirements to be Same Store communities.

Understanding the Numbers: Mid-America Apartment's Finances

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Over the 3 months period, Mid-America Apartment showcased positive performance, achieving a revenue growth rate of 1.4% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Mid-America Apartment's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 30.16% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Mid-America Apartment's ROE stands out, surpassing industry averages. With an impressive ROE of 2.78%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Mid-America Apartment's ROA excels beyond industry benchmarks, reaching 1.41%. This signifies efficient management of assets and strong financial health.

Debt Management: Mid-America Apartment's debt-to-equity ratio is below the industry average at 0.84, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.