In the last three months, 27 analysts have published ratings on Cloudflare NET, offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 10 | 6 | 10 | 0 | 1 |

| Last 30D | 1 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 6 | 4 | 8 | 0 | 1 |

| 3M Ago | 2 | 2 | 1 | 0 | 0 |

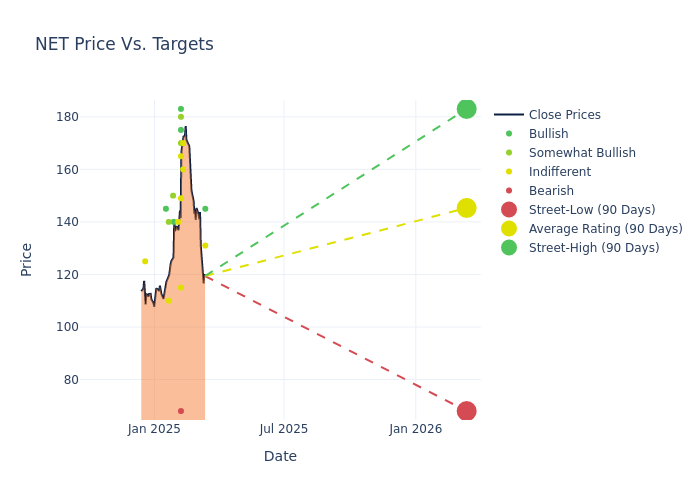

Analysts have set 12-month price targets for Cloudflare, revealing an average target of $147.33, a high estimate of $185.00, and a low estimate of $68.00. Marking an increase of 23.35%, the current average surpasses the previous average price target of $119.44.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Cloudflare's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Fish | Piper Sandler | Lowers | Neutral | $131.00 | $153.00 |

| Mike Cikos | Needham | Lowers | Buy | $145.00 | $185.00 |

| Mike Cikos | Needham | Maintains | Buy | $185.00 | $185.00 |

| Gregg Moskowitz | Mizuho | Raises | Neutral | $160.00 | $130.00 |

| Aaron Samuels | Susquehanna | Raises | Neutral | $170.00 | $95.00 |

| Mark Murphy | JP Morgan | Raises | Neutral | $115.00 | $110.00 |

| Matthew Hedberg | RBC Capital | Raises | Outperform | $170.00 | $123.00 |

| Thomas Blakey | Cantor Fitzgerald | Raises | Neutral | $149.00 | $111.00 |

| Gabriela Borges | Goldman Sachs | Raises | Buy | $183.00 | $140.00 |

| Trevor Walsh | JMP Securities | Raises | Market Outperform | $180.00 | $135.00 |

| John Difucci | Guggenheim | Raises | Sell | $68.00 | $57.00 |

| Adam Borg | Stifel | Raises | Buy | $175.00 | $136.00 |

| Roger Boyd | UBS | Raises | Neutral | $165.00 | $130.00 |

| James Fish | Piper Sandler | Raises | Neutral | $153.00 | $92.00 |

| Mike Cikos | Needham | Raises | Buy | $185.00 | $160.00 |

| Mike Cikos | Needham | Raises | Buy | $160.00 | $110.00 |

| Shrenik Kothari | Baird | Raises | Neutral | $140.00 | $125.00 |

| Joel Fishbein | Truist Securities | Raises | Buy | $140.00 | $120.00 |

| Andrew Nowinski | Wells Fargo | Raises | Overweight | $150.00 | $135.00 |

| Patrick Colville | Scotiabank | Raises | Sector Perform | $110.00 | $87.00 |

| Keith Weiss | Morgan Stanley | Raises | Overweight | $140.00 | $130.00 |

| Fatima Boolani | Citigroup | Raises | Buy | $145.00 | $95.00 |

| Andrew Nowinski | Wells Fargo | Raises | Overweight | $135.00 | $110.00 |

| Matt Hedberg | RBC Capital | Raises | Outperform | $123.00 | $99.00 |

| Gabriela Borges | Goldman Sachs | Raises | Buy | $140.00 | $77.00 |

| Brent Thill | Jefferies | Raises | Hold | $125.00 | $100.00 |

| Adam Borg | Stifel | Raises | Buy | $136.00 | $95.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Cloudflare. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Cloudflare compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Cloudflare's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Cloudflare's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Cloudflare analyst ratings.

Get to Know Cloudflare Better

Cloudflare is a software company based in San Francisco, California, that offers security and web performance offerings by utilizing a distributed, serverless content delivery network, or CDN. The firm's edge computing platform, Workers, leverages this network by providing clients the ability to deploy, and execute code without maintaining servers.

Key Indicators: Cloudflare's Financial Health

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Over the 3 months period, Cloudflare showcased positive performance, achieving a revenue growth rate of 26.89% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -2.79%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Cloudflare's ROE stands out, surpassing industry averages. With an impressive ROE of -1.27%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Cloudflare's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.4% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a high debt-to-equity ratio of 1.4, Cloudflare faces challenges in effectively managing its debt levels, indicating potential financial strain.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.