In the preceding three months, 4 analysts have released ratings for Spire SR, presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

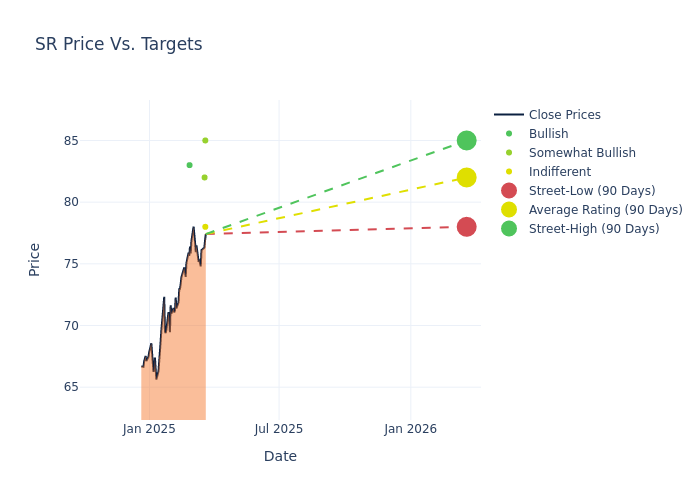

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $82.0, a high estimate of $85.00, and a low estimate of $78.00. Observing a 10.32% increase, the current average has risen from the previous average price target of $74.33.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive Spire. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Byrd | Morgan Stanley | Raises | Equal-Weight | $78.00 | $75.00 |

| Richard Sunderland | JP Morgan | Raises | Overweight | $85.00 | $72.00 |

| Gabriel Moreen | Mizuho | Raises | Outperform | $82.00 | $76.00 |

| Paul Fremont | Ladenburg Thalmann | Announces | Buy | $83.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Spire. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Spire compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Spire's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Spire's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Spire analyst ratings.

Discovering Spire: A Closer Look

Spire Inc is a public utility holding company with three reportable business segments: Gas Utility, Gas Marketing and Midstream. The Gas Utility segment includes the regulated operations of Laclede Gas, Alabama Gas Corporation ('Alagasco') changed its name to Spire Alabama Inc. effective September 1, 2017, and Laclede Gas Company changed its name to Spire Missouri Inc. effective August 30, 2017. The Gas Utility segment generates a majority of the company's revenue but is subject to seasonal fluctuations. The Gas Marketing segment includes Laclede Energy Resources, Inc, whose operations include the marketing of natural gas and related activities on a non-regulated basis and the Midstream segment includes transportation and storage of natural gas. Maximum revenue from residential area.

Key Indicators: Spire's Financial Health

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Negative Revenue Trend: Examining Spire's financials over 3 months reveals challenges. As of 31 December, 2024, the company experienced a decline of approximately -11.56% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Utilities sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Spire's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 11.58%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.56%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Spire's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.7%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.59, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.