Home Depot HD underwent analysis by 14 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 9 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 3 | 5 | 1 | 0 | 0 |

| 2M Ago | 1 | 3 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

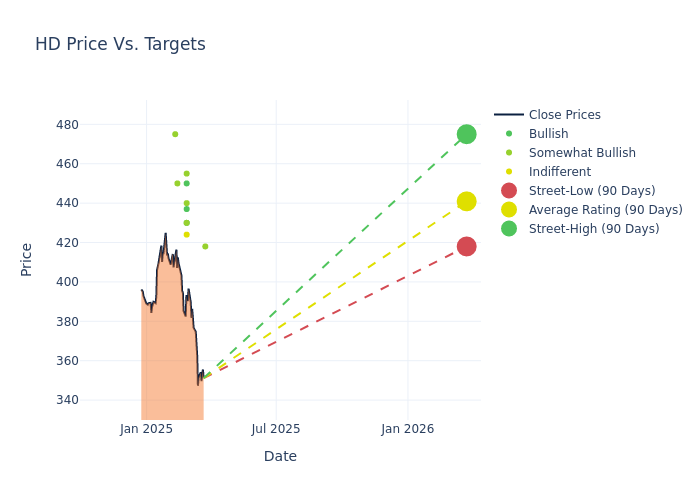

Insights from analysts' 12-month price targets are revealed, presenting an average target of $444.36, a high estimate of $475.00, and a low estimate of $418.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 1.3%.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Home Depot among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Peter Keith | Piper Sandler | Lowers | Overweight | $418.00 | $435.00 |

| Laura Champine | Loop Capital | Lowers | Buy | $430.00 | $465.00 |

| Peter Benedict | Baird | Lowers | Outperform | $430.00 | $440.00 |

| Peter Keith | Piper Sandler | Lowers | Overweight | $435.00 | $455.00 |

| Steven Shemesh | RBC Capital | Lowers | Sector Perform | $424.00 | $431.00 |

| Steven Forbes | Guggenheim | Maintains | Buy | $450.00 | $450.00 |

| Seth Basham | Wedbush | Maintains | Outperform | $440.00 | $440.00 |

| Scot Ciccarelli | Truist Securities | Lowers | Buy | $437.00 | $467.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $455.00 | $455.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $455.00 | $455.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $455.00 | $455.00 |

| Zachary Fadem | Wells Fargo | Raises | Overweight | $450.00 | $440.00 |

| Scot Ciccarelli | Truist Securities | Raises | Buy | $467.00 | $465.00 |

| Christopher Horvers | JP Morgan | Raises | Overweight | $475.00 | $450.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Home Depot. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Home Depot compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Home Depot's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Home Depot analyst ratings.

All You Need to Know About Home Depot

Home Depot is the world's largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and the 2024 tie-up with SRS will help grow professional demand in roofing, pool and landscaping projects.

Unraveling the Financial Story of Home Depot

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Decline in Revenue: Over the 3 months period, Home Depot faced challenges, resulting in a decline of approximately -1.28% in revenue growth as of 31 January, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Home Depot's net margin is impressive, surpassing industry averages. With a net margin of 7.55%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Home Depot's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 48.24%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Home Depot's ROA excels beyond industry benchmarks, reaching 3.1%. This signifies efficient management of assets and strong financial health.

Debt Management: Home Depot's debt-to-equity ratio stands notably higher than the industry average, reaching 9.38. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.