11 analysts have expressed a variety of opinions on VICI Properties VICI over the past quarter, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 8 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 3 | 0 | 0 | 0 |

| 3M Ago | 1 | 3 | 0 | 0 | 0 |

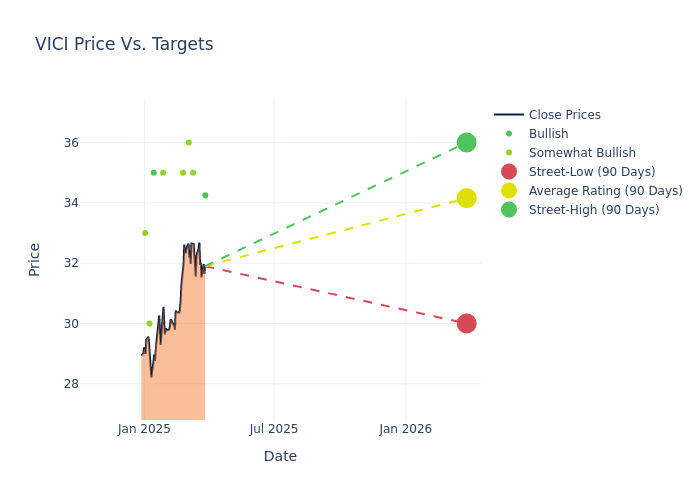

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $34.39, a high estimate of $36.00, and a low estimate of $30.00. This current average represents a 1.69% decrease from the previous average price target of $34.98.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of VICI Properties's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Simon Yarmak | Stifel | Raises | Buy | $34.25 | $34.00 |

| John Kilichowski | Wells Fargo | Raises | Overweight | $35.00 | $34.00 |

| Richard Hightower | Barclays | Raises | Overweight | $36.00 | $35.00 |

| Mitch Germain | Citizens Capital Markets | Maintains | Market Outperform | $35.00 | $35.00 |

| Simon Yarmak | Stifel | Raises | Buy | $34.00 | $33.75 |

| Richard Hightower | Barclays | Lowers | Overweight | $35.00 | $36.00 |

| Greg Miller | JMP Securities | Maintains | Market Outperform | $35.00 | $35.00 |

| Barry Jonas | Truist Securities | Lowers | Buy | $35.00 | $40.00 |

| Richard Hightower | Barclays | Announces | Overweight | $36.00 | - |

| Haendel St. Juste | Mizuho | Lowers | Outperform | $30.00 | $33.00 |

| Richard Anderson | Wedbush | Lowers | Outperform | $33.00 | $34.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to VICI Properties. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of VICI Properties compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of VICI Properties's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into VICI Properties's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on VICI Properties analyst ratings.

Discovering VICI Properties: A Closer Look

VICI Properties Inc is a real estate investment trust based in the United States. It engaged in the business of owning and acquiring gaming, hospitality, wellness, entertainment and leisure destinations, subject to long-term triple net leases. It own nearly 93 experiential assets across a geographically portfolio consisting of nearly 54 gaming properties and nearly 39 other experiential properties across the United States and Canada, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas.

A Deep Dive into VICI Properties's Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3 months period, VICI Properties showcased positive performance, achieving a revenue growth rate of 4.74% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: VICI Properties's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 62.97% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): VICI Properties's ROE excels beyond industry benchmarks, reaching 2.33%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.36%, the company showcases effective utilization of assets.

Debt Management: VICI Properties's debt-to-equity ratio is below the industry average. With a ratio of 0.67, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.